To get ready to file your business taxes, you’ll want to take note of the common tax deductions and credits in this list. If you find some that apply to your business, be sure to collect the necessary paperwork and submit it on your business taxes or hand it off to your accounting service.

Do Tax Deductions Increase Your Refund?

Before we jump into the list of the most common tax deductions and credits, it’s important to understand just how a deduction or credit can impact your taxes. Your small business tax responsibilities are not as simple as filing your taxes as an individual.

As a small business owner, it's likely you file your taxes as a "pass-through" entity, meaning they’re passed on to your personal tax return. The only type of business that pays taxes directly to the IRS is a C Corp. If your business is a sole proprietorship, LLC, or S Corp, your taxes will pass through and show on your personal tax return.

In simple terms, your business pays taxes on your profit. Your profit is the amount left after you subtract your deductions from what your business earned. This means that the more deductions you take, the lower your business profit, which can affect the amount of tax you pay. This is why it’s critical to track your expenses and claim business deductions.

Tax deductions can also increase your tax refund. This can get a little complicated, so bear with us. A refund is a repayment from the IRS for withholding too much tax money. You might get a refund if you choose to withhold a higher-than-normal percentage of taxes from your paycheck or if you overpaid on your quarterly taxes.

Here's a common scenario: A business owner pays quarterly taxes on their expected income but then makes less money than planned. If this was the case, the owner would receive a refund for overpaying on quarterly taxes.

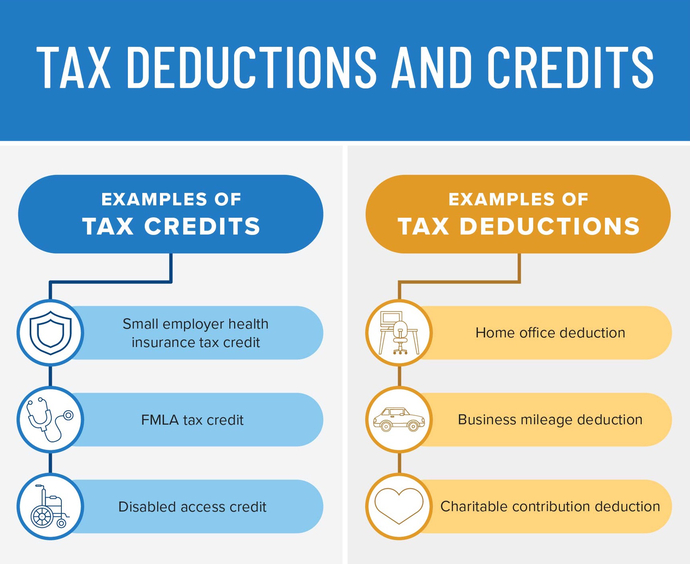

As a small business owner, there are a number of things you can deduct from your business income. These are called "tax deductions." In addition to tax deductions, there are "tax credits. A credit reduces the amount of income tax you owe.

Source

Knowing what you can deduct from your business taxes and potential tax credits that your small business is eligible for will help you navigate tax time this April.

Common Tax Deductions and Credits You Should Know About

As the April 15 deadline to file your taxes with the IRS quickly approaches, you'll want to start gathering your deductions and apply for tax credits as efficiently as possible. These tax deductions and credits are commonly overlooked — get them on your radar to help reduce the amount of money you owe and increase your potential refund.

Startup Costs

There are a number of costs associated with starting your business. You might hire someone to research the market you’re planning to break into or travel to secure contracts with specific distributors. All of the money you spend in planning and preparing to launch your business can be deducted from your business income. The IRS has some helpful information about how to tell if a startup cost is deductible or not.

Home Office Deduction

If you operate your business out of your home, you can deduct part of your home expenses as a home office deduction. This deduction is for those who use a portion of their home regularly and exclusively for business.

With a home office deduction, you can deduct some of your home expenses that are proportionate to the percentage of your home that’s used for business. So, if your home office takes up 10% of your home’s square footage, you can deduct 10% of your home expenses as a business deduction.

Home expenses that can be deducted include:

- Utilities

- Rent or mortgage interest

- Depreciation

- Maintenance

If you don’t want to do all that math, you can use the IRS’s standard home office deduction. This allows you to deduct $5 per square foot of your home used for business purposes, up to 300 square feet.

Mileage Deduction

As a small business owner, you can deduct the mileage you drive for business purposes in your personal vehicle. The mileage deduction rate for 2022 was 58.5 and 62.5 cents per mile, and in 2023, it increased to 65.5 cents per mile. This deduction works best if you track it all year long. You can track your miles by hand or use a mileage tracking app such as MileIQ or QuickBooks.

If you haven't tracked your miles for the last year, you can recreate them. Look back on your calendar for any business appointments. Then, you can use your phone's map app to see your location on those days. This will allow you to calculate the number of business miles you drove throughout the year.

Health Insurance and Medical Expenses

As a small business owner, some of your medical expenses are tax deductible. You can deduct the following:

- Health insurance premiums for you and your family

- Medical expenses, if they exceed 7.5% of your taxable income

- Exercise equipment, a gym membership, or a swimming pool if your doctor recommends exercise

Education Deductions

Learning new skills and completing ongoing training and education is a critical part of being a small business owner. As such, you can deduct some education expenses from your taxes. According to the IRS, to be deductible, an education expense must be something that “maintains or improves skills needed in your present work.” If this criterion is met, it can be deducted from your taxes.

Business Insurance

If you take out small business insurance, that expense is deductible from your taxes. Deductible insurance expenses include:

- Business continuation insurance

- Property insurance

- Liability coverage

- Malpractice insurance

- Workers’ compensation costs

- Auto insurance for business vehicles

- Employee’s life insurance

- Business interruption insurance

Office Supplies and Software

Another business deduction you’ll be eligible for as a small business owner is for office supplies and software. If you buy something that will be used to operate your business, it can be deducted.

Common business supply deductions include pens, paper, planners, laptops, computers, and software such as Microsoft Office, Zoom, or QuickBooks. Office supplies can even include big items, such as a desk or office furniture to outfit your home office. This is just a shortlist of possible software and supplies you might need for business and would be eligible to deduct.

Meals, Coffee, and Entertainment

If you’re planning to take clients out for lunch or entertain a potential client in hopes of getting their business, you can deduct those expenses. An important thing to note about this deduction: Meals are only deductible up to 50%. If you’re planning to deduct meals and entertainment expenses from your taxes, be sure to save your receipts and note the purpose of each.

Employee Salaries, Benefits, and Gifts

If you employ people in your business, their salaries, bonuses, and commissions are tax-deductible. You can also deduct employee gifts up to $25 per year, per employee.

As a small business owner, you benefit by knowing what expenses you can deduct from your taxes and optimizing those expenses to limit your end-of-year tax burden. If you’re ever not sure about deductions, you can find a number of business tax resources online to help guide you.