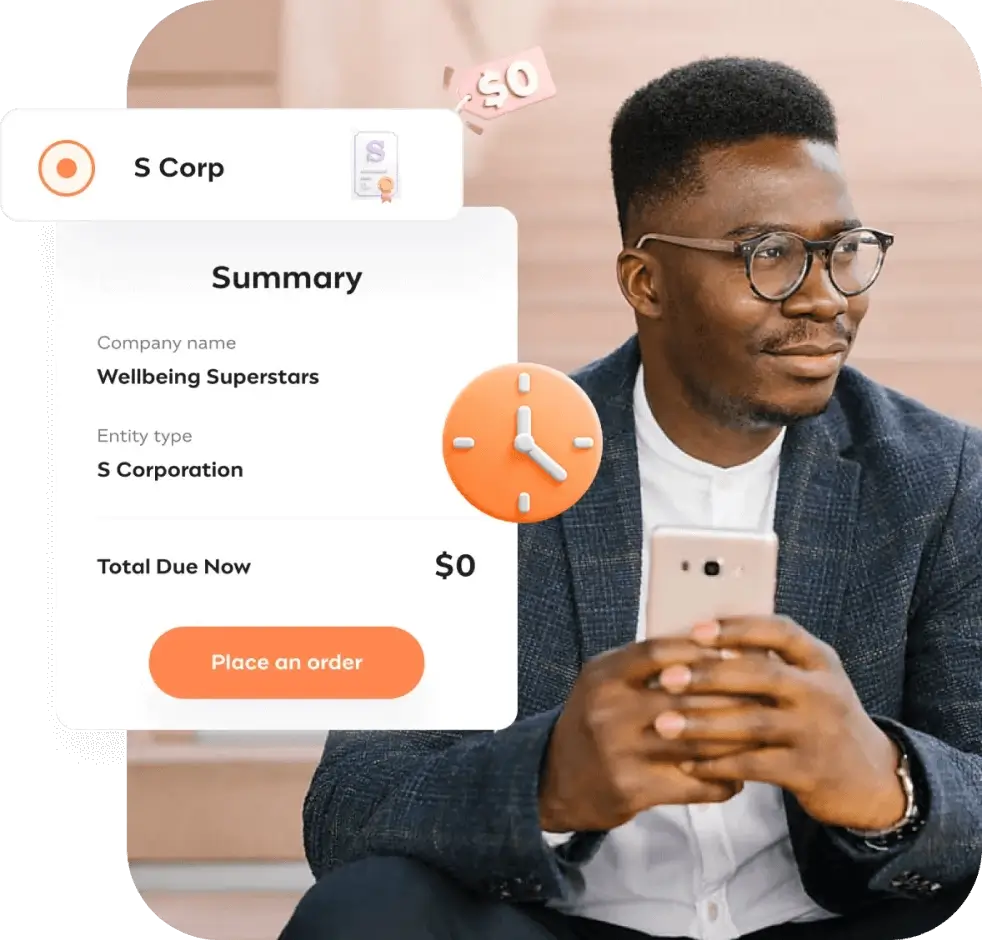

Save Money & Time with Incfile’s Free S Corp Formation

While some providers charge $149+, we don’t charge a thing. Streamlined processes keep our costs down, so we can pass the savings back to you. Form your S Corp with us for free and spend your valuable time and money on what really matters — growing your business.

Discover the Benefits of Forming Your S Corp with Incfile

Join the 1,000,000+ entrepreneurs and small business owners who've formed and grown their businesses with Incfile since 2004. Get industry-leading support and a host of other amazing benefits to kickstart your business with confidence.

-

Get Your EIN Business Tax Number Fast

Included free in our Gold and Platinum formation packages; Get your EIN within 1 business day.

-

Free S Corp Filing, Only Pay the State Fee

Get economical, personalized S Corp formation. When you’re starting a business, every dollar counts.

-

Claim Your Free 1-Hour Tax Consultation

Talk to a business tax expert for free with our Gold and Platinum formation packages.

-

Easily Devise Your Corporation Bylaws

No need to hire an attorney. Simply create corporation bylaws using our personalized incorporation kit.

-

Prepare & File Your Articles of Incorporation

Every Incfile formation package includes help drafting, preparing and filing Articles of Incorporation.

-

Free Registered Agent for the First Year

Get access to your easy-to-use Registered Agent service free for a full year ($119/annually after that).

-

Experience Entrepreneurship Made Easy

Get a business banking account, domain name and email fast with the Platinum package.

-

No Hidden Fees, No Contracts, Ever

Nobody gives you more for less. Get unprecedented value for your money and the best user experience.

-

Grow Your Business with Tailored Services

Choose any additional S Corp services from within your business dashboard if and when you need them.

-

Fast and Friendly Customer Service, 24/7

Benefit from lifetime customer support. Talk to dedicated incorporation specialists, not salespeople.

-

Stay on Top of Important Due Dates

Receive email and text notifications, order updates and free lifetime compliance alerts within your dashboard.

-

Modern & Simple Personalized Dashboard

All your business essentials, all in one place. Access everything you need, whenever you need it.

-

Customizable Business Contract Templates

Ensure that all your contracts, documents and forms are watertight without the cost of hiring a lawyer.

-

Save Money on Taxes with IRS Form 2553

Choose S Corp election and benefit from savings on your business taxes.

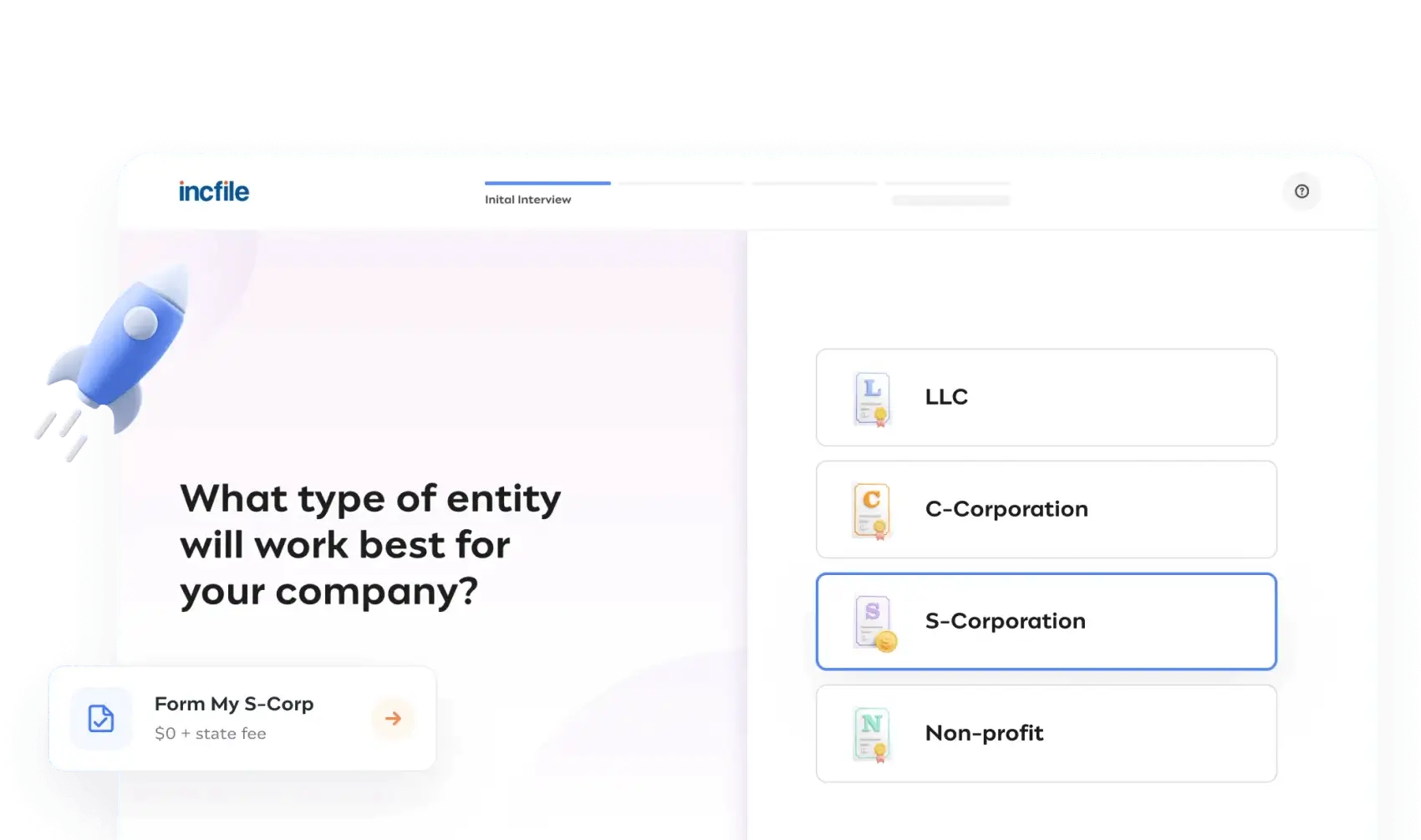

How to Form an S Corporation

with Incfile

3 Simple Steps

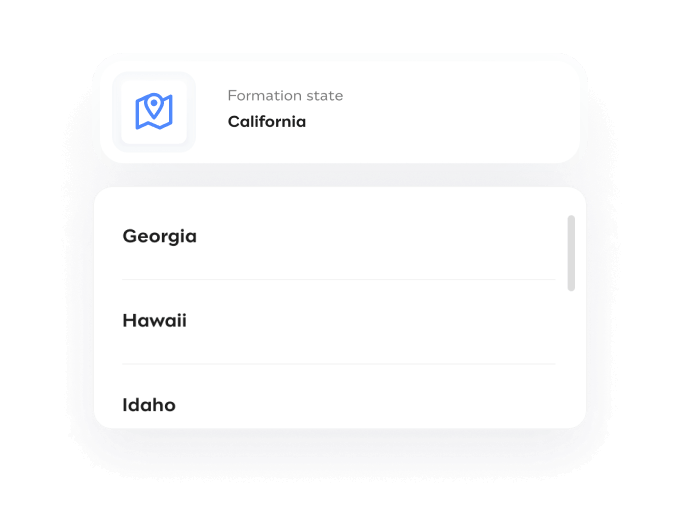

Choose Your Incorporation State

Rules and regulations vary by state, so make sure you know what state you want your business to be in to meet your needs. You don’t have to choose the state you live in, either!

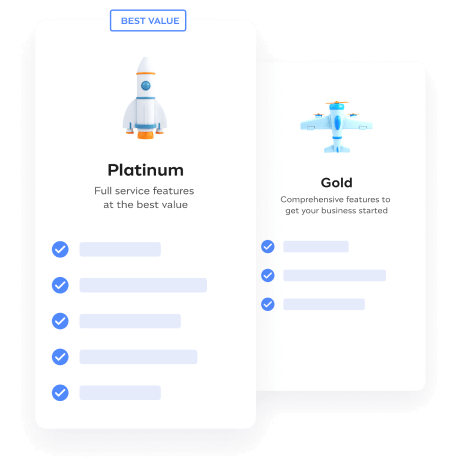

Choose Ideal Package for Your Situation

Whether you only need the basics or want more extensive business support, Incfile has the ideal business formation package to help you start and grow your corporation.

Tell Us About Your

S Corp

Complete an online order form with the details of your S Corp. You’ll need to supply information about the number of directors and information relating to stock, including the value of shares and number of shareholders.

%20(1)s-corp_best-company_ever-1.png)

You’ve placed your order, now what?

Review Your Order Details

Access your intuitive and easy-to-use business dashboard where you can review your order details and ensure everything is as it should be.

Receive Filed Documents in Your Dashboard

Your filed articles and any additional documents and services are easily accessible from within your custom business dashboard. You’ll get notifications once they’re ready.

Want to Know More About Starting an S Corp?

Download our Why Form An S Corp Guide now.Loved by 1,000,000+ Entrepreneurs Across All 50 States

Incfile is the best! Professional & always available to answer all my questions. I'm so grateful.

"Incfile has been great to work with. Their prices are reasonable and they exceed expectations."

"Easy, smooth, one of the best business decisions I’ve ever made, was to utilize Incfile."

"Great experience overall. I would recommend Incfile to anyone just starting out."

"Always easy, always fantastic. Used this company for over 5 years. Thanks for a great company."

"The process was easy. The service is amazing. The products are top notch. What else can you ask for."

Common Questions About Forming an S Corp

Yes! With our $0 S Corp formation package, you only pay the fees required by your state. Incfile’s filing services are free.

Since 2004 we’ve been improving and perfecting our service. Streamlined processes keep our costs down so we can pass the savings back to you. The result is a low-cost yet personalized business formation with fast and friendly service.

The Silver package costs $0 + state fee and includes the fundamentals needed to start an S Corp.

The Gold package is $199 + state fee. It’s the option most clients choose due to its comprehensive feature set to get your business started. Your EIN Business Tax number is included (while most other incorporation services charge extra fees on top of their equivalent package price for this). Our Gold package also includes IRS Form 2553, corporation bylaws, operating agreement, banking resolution, lifetime company alerts, online dashboard access, unlimited phone and email support, a business banking account and a business tax consultation.

The Platinum package is our best value package at $299 + state fee and offers a full suite of features. Platinum includes all of the Gold benefits plus business contract templates, expedited filing and a domain name and business email.

When you form your S Corp with us, our Registered Agent service is free for the first year and is only $119 per year after that.

For more information on our services and prices, visit our how it works page.

Each state has specific rules and requirements regarding Registered Agents, naming rules, business licenses, etc.

Find out more about S Corps in your state and review our business entity comparison chart to learn about liability protection, business fees and tax.

Filing costs to form an S Corp can vary from state to state. Use our free filing fees chart to easily compare state fees before you start your business.

No! We pride ourselves on transparency. There are absolutely no hidden costs associated with forming your business.

With our $0 S Corp package, you only pay the fee required by your state. This is the state fee for forming an S Corp that you’d need to pay even if you were doing the entire process on your own. Some states do charge online processing fees to file your paperwork, but those fees are from the state, not from Incfile. Incfile’s services are entirely free if you choose the $0 S Corp package.

Our mission is to provide you with an exceptional and modern experience coupled with unparalleled value. Think of us as your business guide. We make registering an S Corp as easy and low cost as possible, so you can focus on the important things.

Incfile’s standard processing time for sending your data to the relevant state is 1 day.

State filing times can vary from three to twelve weeks. You can choose to pay an expedited fee for Incfile to process your paperwork faster (included in the Platinum package).

Sometimes your chosen state may offer expedited processing through their systems, too. If they do, we’ll let you know it’s an option available to you. Use our comparison tool to quickly and easily compare state filing times.

Yes, we have a lot of helpful content! Download our “What Is an S Corp” guide and learn more about S Corps here. Check out our Resource Center for in-depth information on every aspect of planning, starting and growing your business.

Of course! We believe in educating our clients and providing wide-ranging guidance at every step in the formation process and beyond.

If you need additional support, you can contact us via Help Chat in your personalized dashboard. We also offer customer service to assist with any transactional questions.

Do you prefer to speak to an incorporation specialist over the phone? No problem! Get in touch on 844-830-8267 Monday-Friday from 9 a.m. to 6 p.m. CST.

To create an S Corp, you need to first file Articles of Incorporation for either a C Corporation or an LLC.

As soon as your Articles of Incorporation are accepted by the state in which your will business operate, Form 2553 needs to be filed to elect S Corp tax status.

There are several reasons why business owners choose to form an S Corporation. One of the main advantages of an S Corp is that it gives owners limited liability protection that protects their personal assets in the event of a claim.

S Corporations are also subject to lower income and self-employment taxes.

It’s important to understand the differences between S Corps and C Corps and the benefits of each to make an informed decision.

Check out our S Corporation tax calculator to find out how much you could save in taxes.

Your business needs to meet specific requirements to be able to qualify for S Corp status according to the IRS. It must:

- Be a domestic corporation

- Only have allowable shareholders — which can include individuals, specific trusts and estates, but can’t include corporations, partnerships or nonresident shareholders

- Have only one class of stock

- Not be considered an ineligible corporation — such as certain insurance companies, financial institutions and domestic sales corporations

- Elect S Corporation status by submitting Form 2553

Incfile can file your S Corp election for you (for only $50) to help you save money on your taxes. Simply complete our quick and easy online order form and let us take care of the rest for you hassle-free.

You can also file Form 2553, electing for S Corporation tax yourself if you prefer. You’ll need to:

- Go to the IRS website

- Locate the section about S Corporation Tax Elections

- Download Form 2553

- Collect all the information needed to complete the form and then fill it in

- Return the completed form to the IRS (by mail or fax)

- Sit tight while you wait for notification that your tax election has been accepted

To form an S Corp, Form 2553 must be completed and filed with the IRS. Your business is not able to benefit from pass-through taxation until your application form is approved by the IRS.

S Corps also need to file their annual tax returns to report income, losses, credits and deductions using Form 1120-S.

Usually, an LLC that is taxed as a sole proprietorship will pay more taxes due to self-employment tax on total profits.

Filing for S Corp tax status usually results in tax savings.

Find out more about S Corp election and read up on S Corp distribution.

It depends since each has advantages and drawbacks. It’s vital to understand the differences between LLCs vs. S Corps and the benefits of each to ensure you make the best decision for your business.

An LLC could be best for your business if you…

- Need to sell stocks to get financing

- Want foreign owners or investors

- Would like simple administration and compliance

- Want relatively simple tax returns and lower accountancy fees

- Would like the option to pay less self-employment tax by filing Form 2553

An S Corp could be best for your business if…

- You want to sell stock to private investors to get funding

- You’d like to pay less self-employment tax

- All your owners are U.S. citizens or residents

- You don't mind a moderate level of management and administration

- You're ok with slightly more complex tax returns and potentially higher accounting fees

An LLC will probably be the best option for most small businesses, but you might find yourself in a circumstance where an S Corp better suits your needs.

Yes, there are no legal requirements for an S Corp to hire or have employees.

If your business is in an S Corp and you do decide that you want to hire employees, you’ll need to comply with specific tax and reporting requirements.

Form Your S Corp for Free

Kickstart Your Business with Incfile Now