Let’s begin with the bad news: This past year, Americans have seen a steep rise in inflation. In fact, it’s been the steepest rise in inflation in over 40 years. Products and services cost more in 2022 and into 2023, meaning your dollar is not going as far as it used to.

Now, for the good news: 2023 federal tax brackets are adjusting higher to counter the rising inflation. This means that your tax bill will be smaller in 2023. Let's look at the different tax brackets, how to figure out your tax bracket, and other changes that will affect your 2023 taxes.

What’s New in 2023?

As a result of inflation, the government has made tax code adjustments to help reflect this new reality and the effect it has on almost everyone’s finances.

Here are some of the recent changes announced by the Internal Revenue Service (IRS) for 2023 that apply to tax returns that will be filed in 2024:

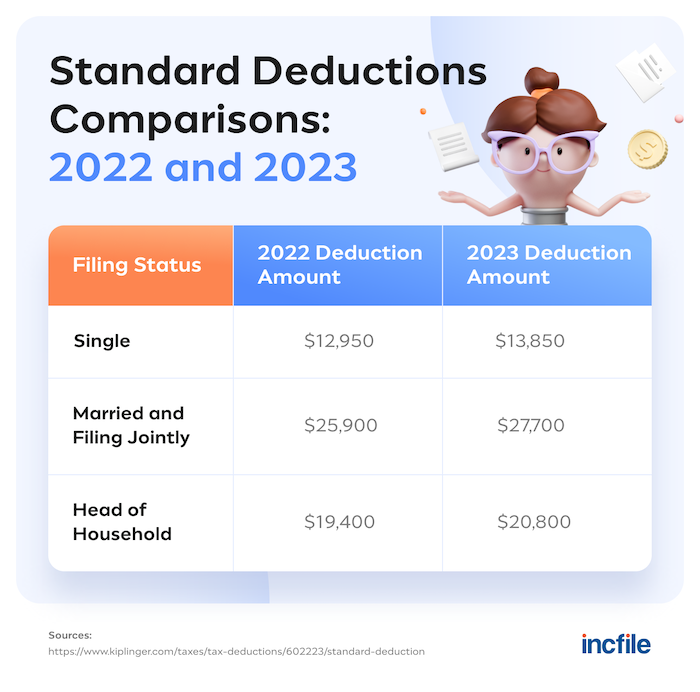

- The standard deduction for single taxpayers or married couples filing separately has increased by $900.

- The standard deduction for married couples filing jointly has increased by $1,800.

- The standard deduction for heads of households has increased by $1,400.

- The income level for all tax brackets has increased by 7.1%.

- Retirement plan contributions have increased by $1,000.

- Health Savings Account (HSA) contributions increased by $200 to $3,850.

- Earned Income Tax Credit (EITC) went from $6,935 to $7,430.

- Alternative Minimum Tax (AMT) income threshold has increased to $126,500 for married couples (previously $118,100) and $81,300 for single filers (from $75,900).

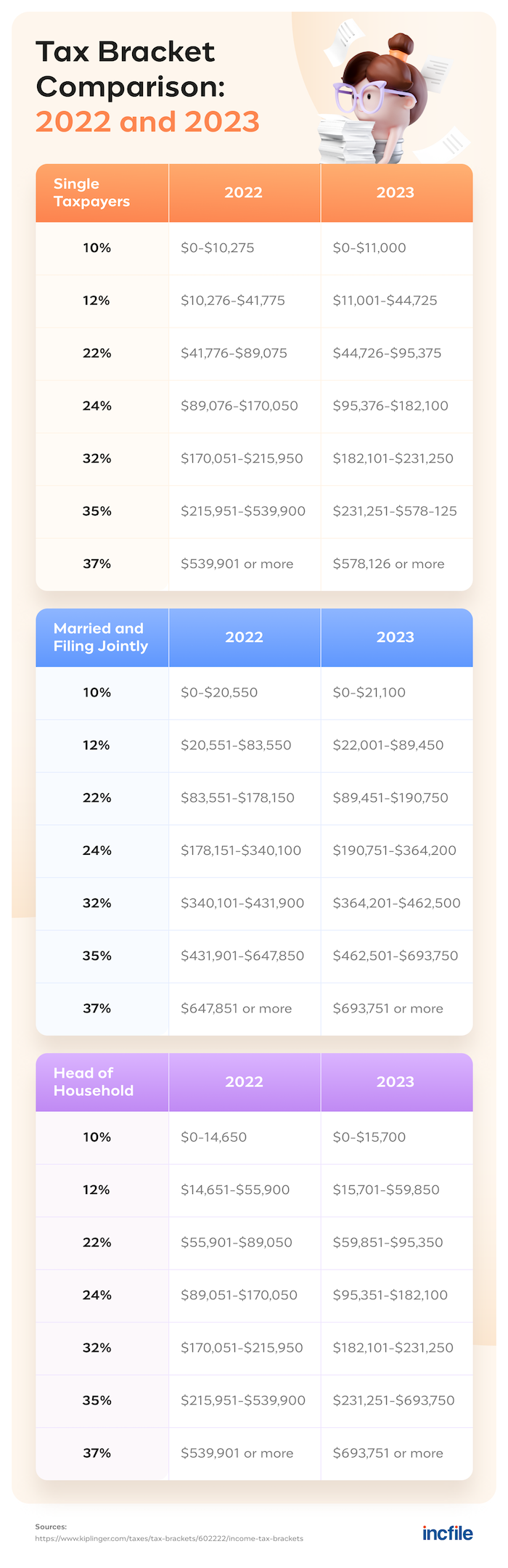

Income Tax Brackets: 2022 and 2023

The changes announced by the IRS for 2023 go into effect on January 1, 2023. For your 2022 taxes, the filing deadline was April 18, 2023. Due to inflation, the government has stepped in to adjust the federal tax brackets. This will help tax filers file their 2023 taxes next year, but 2022 tax filers will not see these benefits this year.

The IRS has designated seven income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Depending on a taxpayer’s filing status, their taxable income will fall within one of these seven tax rates. Taxpayers also have the option to pay their taxes as single filers, married individuals filing joint returns, or heads of household.

Let’s look at a quick side-by-side comparison of the tax brackets and rates for 2022 against the changes made for 2023.

How to Identify Your 2023 Federal Tax Bracket

A taxpayer’s responsibility is based on income. This can be calculated as an individual, head of household, or combined with a spouse if married. The tax policy followed in the United States is known as the “progressive” tax income system. This basically means that the more you earn, the higher the tax bracket you’ll be in, and the more you’ll need to pay in taxes.

Here are some pointers on how to calculate your taxable income:

1. Do not use your salary as the basis of your federal tax bracket.

Example: If you are a single filer who earned $92,000 in 2023 and you're in the 22% tax bracket, that does not mean you'll pay 22% taxes on all $92,000 or that your taxable income is $92K.

2. Deduct your eligible standard deduction against your salary.

Example: If you earned $92,000 in 2023, you are allowed to take a standard deduction of $13,850. This will now bring your taxable salary down to $78,150.

3. Deduct the number of any additional eligible deductions allowed by the IRS.

Example: You’ve reduced your income to $78,150, but you also make contributions to your retirement account totaling $7,500. This needs to be subtracted from your taxable amount of $78,150, bringing your taxable amount down to $70,650.

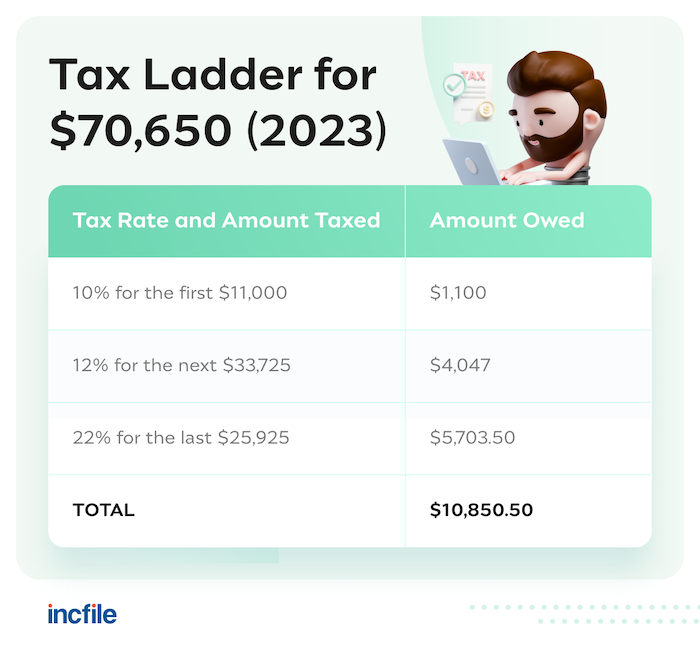

Let’s assume that, in this example, the taxpayer has no children, no capital gains or losses, and has taken the standard deduction allowed by the IRS rather than itemizing the deductions. This will give the taxpayer a taxable income of $70,650, which would fall within a federal tax bracket of 22%. But hold on — this doesn’t mean that all of your income will be taxed at 22%.

To figure out how much you owe in taxes, you’ll need to break down this taxable figure even further. This will require plugging in the taxable amount into the different tax brackets until you reach 22%.

For this example, once you've calculated the amounts due by bracket, the final tax bill due to the IRS would be $10,850. This would roughly come out to a tax of about 15.3% of the adjusted gross income of $70,650.

How to File for a Lower Tax Bracket

Depending on a taxpayer’s situation, there are a few ways to lower taxable income and possibly file in a lower tax bracket.

For example, the Child Tax Credit is applicable if you have one or more children. Other factors that may affect a filer's taxes may include any capital gains or losses from the sale of assets (for example, stock shares), business-related deductions, uncovered medical expenses, and charitable donations.

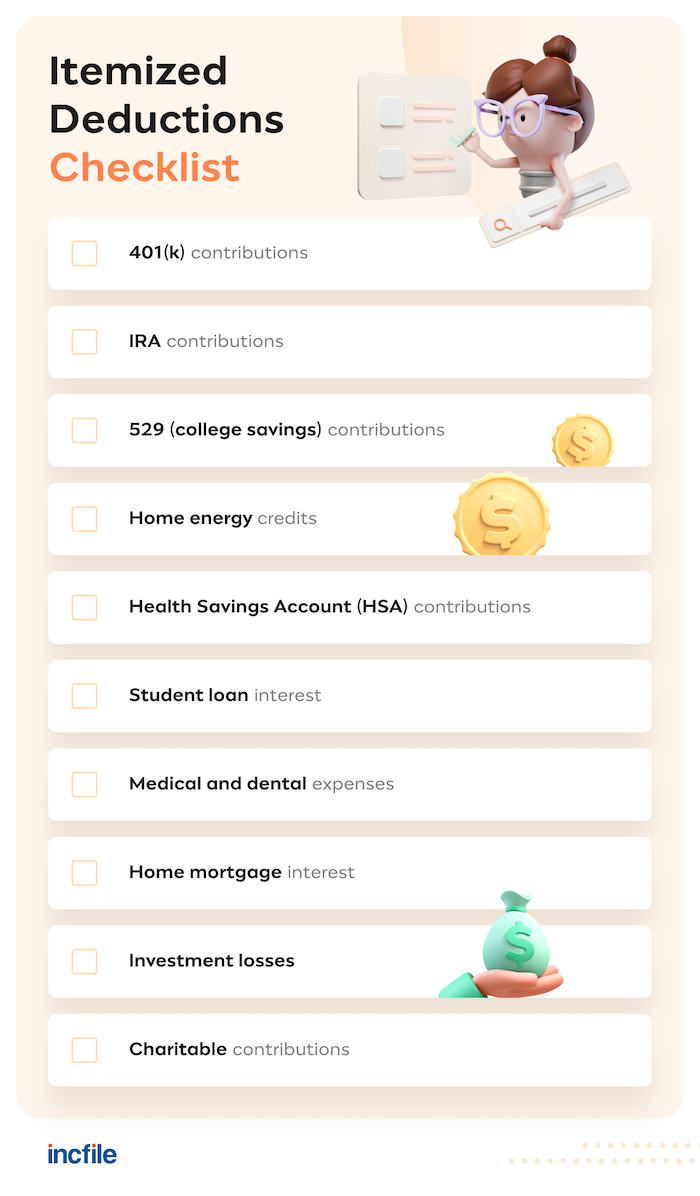

Consulting with a tax accounting professional will help calculate how these additional deductions will affect the final taxable income amount. Sometimes, it may be worth itemizing deductions instead of going with the standard deduction. When itemizing, consider all the allowable deductions, including charitable donations, property taxes, and mortgage interest. These deductions can help reduce the amount of money that is taxed, reducing your 2023 federal tax bracket and tax bill.

Here’s a checklist to help guide you with itemizing your deductions:

Itemized Deductions Checklist

- Home mortgage interest

- Medical and dental expenses

- Charitable contributions

- Real estate taxes

- State and local taxes or sales taxes

- Personal property taxes

- Gambling losses

- Casualty and theft losses (from a federally declared disaster)

- Investment interest

Other Deductions Checklist

- IRA contributions

- Health Savings Account (HSA) contributions

- Student loan interest

- Investment losses

- Educator expenses

- Employee business expenses (Armed Forces reservists, qualified performing artists, fee-basis state, and local government officials)

Five Commonly Asked Tax Questions

Preparing for taxes can be stressful. You must make sure you have the proper paperwork and documentation reflecting a year’s worth of financial activity. To help ease any potential stress and help add a little bit of clarity, here are five of the most commonly asked tax-related questions:

Will Tax Returns Be Bigger in 2023?

For tax returns filed in 2023 for the 2022 tax year, "refunds may be smaller in 2023," According to the IRS. Since there were no stimulus payments in 2022 like there were for the pandemic in 2020 and 2021, "taxpayers will not receive an additional stimulus payment with a 2023 tax refund."

In addition, taxpayers who opt to go with the standard deduction instead of itemizing "won’t be able to deduct their charitable contributions." This is because Congress did not extend the tax break related to charitable giving, which allowed single filers to claim $300 in cash donations. (For married couples filing jointly, the amount was $600.)

How Can I Reduce My Taxable Income?

Nobody wants to be surprised by a high tax bill. Here are some strategies to help reduce your taxable income and keep more of your hard-earned money:

- Add money to your retirement plan. The IRS does not tax money contributed to 401(k) plans. For 2023, the limit is $22,500.

- If you're 50+, you can contribute up to $7,500 more to your retirement account.

- Invest in your children's future by starting a college savings plan. If you already have one, you can contribute up to $17,000, which knocks the equivalent amount from your taxable income.

- Fund your Health Savings (HSA) and Flexible Spending (FSA) accounts. The limit for 2023 is $3,850 (individual) and $7,750 (family) for HSA and $3,050 for FSA. You can raise the limit on the HSA by another $1,000 if you are over 50.

- Sell your losing investments. You can deduct capital losses of up to $3,000 or $1,500 if married filing separately.

- Keep track of your medical expenses. You can claim any additional costs that are over 7.5% of your adjusted gross income.

- Review your W-4 provided to your employers. Perhaps you do not have enough withholdings? You can do this at any time of the year.

- Give to charities. You can donate clothes, household items, and even an old car.

How Much of Social Security Is Taxable?

If your total income is more than $25,000 as a single filer and $32,000 as a married couple filing jointly, then you’ll need to pay taxes on up to 50% of your Social Security benefits. If you make more than $34,000 as a single filer or more than $44,000 as a married couple filing jointly, then up to 85% of your Social Security benefits may be taxable.

Should I Itemize or Claim the Standard Deduction?

The answer to this question will depend on whether your itemized deductions exceed the standard deduction amounts offered by the IRS. For example, if your deductions are more than $13,850 as a single filer for 2023, then you should go with itemizing your deductions. If your deductions are less than $13,850, claim the standard deduction.

Can I Extend My Tax Filing?

Yes. If you need more time to file your 2023 taxes, due in April 2024, you can file for an extension by completing and submitting Form 4868. This form can be delivered to the IRS by mail or online. Just make sure that this is done before April 18, 2024. An extension will give you close to six more months to submit your tax return. Those filing for an extension have until October 15.

Get Tax Help This Tax Season

If you want to stay on top of your tax game, but don’t have time to keep up with all the paperwork and IRS changes, consider using Incfile's Bookkeeping and Accounting service. We'll maximize your tax credits and deductions so you can spend more time operating, managing, and growing your business.