The Shopify platform boasts 1.75 million sellers, making it one of the most popular ecommerce tools available to business owners. If you're currently using Shopify or plan to do so once you launch your own business, you might be wondering if you need a business license for Shopify. Generally, you don't need a business license to sell on Shopify, but there are a few scenarios where you might.

Here, we've got all the answers you need to determine whether you need a business license for Shopify, how to get one, and what it all means for your online store.

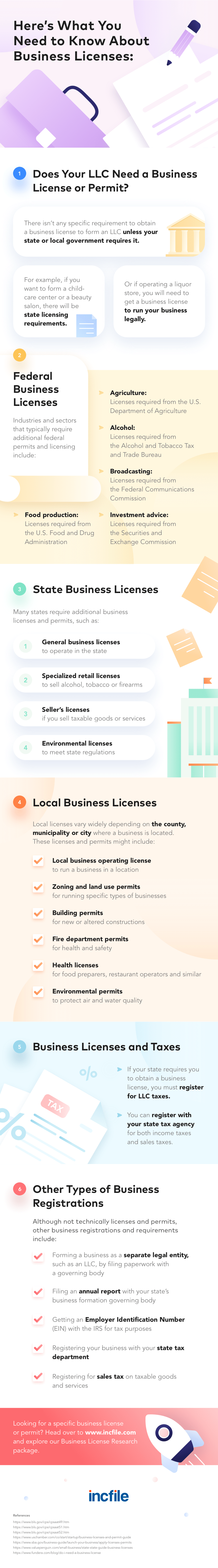

What Is a Business License?

A business license provides legal proof that a business owner has met all regulations to operate a business at the local, state, or federal level. Business licenses are granted to owners who are in compliance with whichever agency approves the license, which is typically a government or industry organization.

Some professions or business types may require licensing at different levels, so it's always important to check with governing bodies in your profession, in your state, and in your city or county to ensure you meet all the requirements.

Business Licenses and Shopify

Now that you understand what a business license is and what it's used for, you may still wonder: Do I need to get a business license for my Shopify business? The short answer is no, you generally do not need a business license to use Shopify. There are, however, a few circumstances in which you'll need to have a business license, including:

- If you earn more than $20,000 per month via Shopify

- If you store regulated inventory in your home (anything that requires a health permit, like some foods, plants, supplements, or cosmetics)

- If you require a professional or government license based on the type of business you operate or the items you sell

Outside of these scenarios, you are free to run a business on Shopify without a business license. Again, it's vital that you check requirements at all levels to be certain you're in compliance with local, state, and federal law.

Sales Tax Considerations

Though you don't typically need a business license, you may need a particular type of permit to collect sales tax on the items you sell. The type of paperwork or application you'll need to fill out will vary by the state in which you formed your business, but it may also depend on where you have nexus.

Nexus refers to where and how your business is taxed on the sale of your products or services. Often, your nexus starts with where you have a physical presence (where your business was legally formed), but it can expand and grow based on how much you sell in a particular location.

If you're selling via Shopify, it is critical to understand your tax nexus and how it may determine which permits you need to have on hand. If you're making a lot of sales and they're coming from all over the U.S., you might benefit from using Shopify Tax, a service that helps you determine where you have nexus and what taxes you need to collect and report. Shopify Tax is free, up to an annual threshold of $100,000 in sales. Beyond that, it's a fee-based service that varies based on your Shopify membership.

Business Licenses for LLCs or Sole Proprietorships on Shopify

Does your business structure change your requirements for having a business license to sell on Shopify? Not really. Both LLCs and sole proprietorships (businesses without a legal business structure) must meet the same requirements mentioned above.

It is, however, sometimes easier when you have an LLC or other business entity that identifies you as a legitimate business when registering for your Shopify account. This allows you to set up your shop using your registered business name and EIN, which you'll receive if you switch from a sole proprietor to an LLC owner.

No LLC? No problem. Sole proprietors can still set up and run successful businesses via Shopify, with a few minor adjustments. First, if you don't have a legally registered business name, you might want to consider a DBA, or Doing Business As, which is a filing that allows you to operate under a name that's different from your own.

Sole proprietors will also need to keep an eye out for 1099 forms. These tax forms are sent by Shopify to contractors, freelancers, and sole proprietors, and they'll detail your earnings for the previous year. You'll then need to use your 1099 to file your taxes.

Do You Need to Have a Business License to Dropship on Shopify?

You do not need to have a business license to dropship on Shopify — just like other Shopify businesses, dropshippers are only required to have a business license if they earn more than $20,000 on Shopify per month, regulate inventory from home, or require a professional or government license.

Dropshipping through Shopify is a popular choice because it's a business you can start with relatively little money. Another cost-saving bonus for dropshippers: licenses and permits are typically worry-free. Why? Because the suppliers are the ones storing the goods to be shipped, making the suppliers liable for meeting codes and maintaining all necessary licenses — not the dropshipper.

Do You Need a Seller's Permit to Sell on Shopify?

You may need a seller's permit if you're selling on Shopify, and it all depends on the aforementioned nexus. If you have nexus in a particular state, then you will need to comply with their sales tax requirements, regardless of where your business is based or where you ship from.

Most states require a seller's permit (which may also be called a resale certificate or sales tax permit) if they collect sales tax on items sold in the state. Actual requirements, forms, and permit fees vary, so it's always best to check permit requirements across all 50 states.

How to Get a Business License

Wondering how to get the necessary licenses and permits for your business? We've got you covered.

Choose Your Business Structure

There are numerous perks and benefits to having a legal business structure, especially when it comes to legal liability and tax filing. You aren't required to have a legal business entity to use Shopify, but it's always recommended for the sake of personal asset protection and for the separation of your personal and business finances.

An LLC is the most common structure for small business owners, largely due to its flexibility and cost-effectiveness. It's a great choice for a Shopify business, especially if you find you have nexus in different states and need to collect and pay sales tax.

You can form an LLC in the state you choose (with a legal street address) on your own, or you can use a business formation service. With Incfile, you can form an LLC for $0 + your state fee.

Secure an EIN

An EIN, or Employer Identification Number, is critical for businesses that need to collect and report sales tax. Your EIN is how your business is identified by the IRS, and it provides other benefits like making it easier to open a business bank account or apply for necessary business licenses. You can apply for an EIN directly with the IRS, or you can use an EIN service to secure an EIN and start using it right away.

Research Business Licenses

Because the requirements for licenses and permits vary so vastly between locations and industries, it's important to stay on top of all those your business might need. You can start your research with your local Chamber of Commerce or with the Small Business Administration. You can also select your state below to see license and permit requirements.

If you have nexus in multiple states or other considerations to make, it might be time to look for outside support. Incfile's Business License Research Package will ask important questions about your business and then send you a complete report of everything you need to stay legal and compliant.

Apply With the Appropriate Agencies

Once you know what you need, you can submit applications to the organizations or agencies that will grant your licenses. If you purchase our research package, you'll get everything — a list of the licenses and permits required for your business, all the forms you need to apply, and detailed instructions on how to submit your applications with the right state or federal agencies.

FAQs About Shopify Businesses and Licensing

Need to know more about getting the right business licenses for your Shopify biz? Here are the answers to the web's most commonly asked questions:

Do I Need a Sales Tax ID or Tax Identification Number to Sell on Shopify?

You may or may not need a sales tax ID to sell on Shopify — it all depends on if you're selling taxable goods or if you have sales nexus in a state or states that require sales tax.

If you find that you need to collect sales tax, you'll have to submit your sales tax ID with the state in which you're collecting, as well as in your Shopify account. Your sales tax ID is most frequently an EIN, which acts as a Social Security number for your business.

Your tax identification number is something you'll need to acquire if you have an LLC or other legal business entity. As mentioned above, that's most often an EIN. However, if you're a sole proprietor, your social security number becomes your tax ID, which you can use to file your taxes.

Do You Need a Business to Start on Shopify?

Whether you need a business to start on Shopify depends on your definition of "business." If you mean a legal business structure, the answer is no, you don't have to have an LLC or any other legal entity before you start selling on Shopify.

However, depending on what you sell, where you're located, or what industry you're in, you might need the appropriate business licenses or permits. It's always recommended to form a legal business structure like an LLC and research all licensing requirements before you get started.

Can Anybody Sell on Shopify?

Yes, anybody can sell on Shopify if they meet the requirements. To sell on Shopify, you must sell approved goods, products, or services, and you must have a secured domain, a return and exchange policy, and a Shopify subscription. Once you've got all that, you're good to go.

It sounds easy, but it's important to remember that all Shopify sellers must still comply with their local and state governments and maintain any required business licenses and permits at the state and federal levels. Incfile has helped launch over 1 million businesses — use our business license research package to ensure you're ready to start selling on Shopify.