The decisions you make now for your business can often be instrumental in your future. No matter what your industry is or how long you’ve been in operation, you always have the opportunity to course-correct and improve how you run your company. However, in order to make the best calls regarding your business, you need to remain constantly vigilant. It takes great care to consistently build your knowledge about what choices are available to your company. And one key distinction you need to understand is the difference between getting a business license and establishing yourself as an LLC.

By now you’ve probably heard a lot about business licenses and LLCs, and maybe you even understand the arguments for or against each. But if you haven’t yet researched how a business license and/or an LLC could benefit your company, take care in knowing that we’re here to break this down: what they both are, how they work and which will best benefit your business long-term. So let’s get delve into the world of business licenses vs. LLCs.

The Case for LLCs

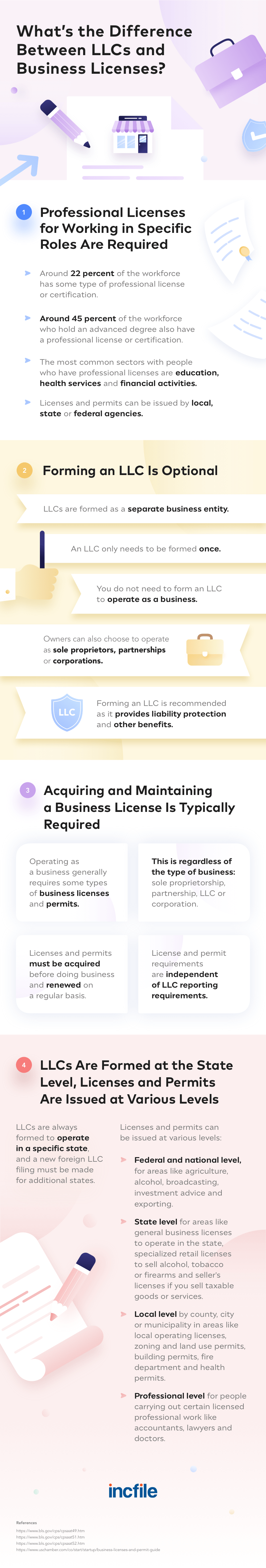

What is a limited liability company (LLC)? Sure, you’ve heard of them, but you still may not understand what it means to be an LLC. At its most basic, an LLC is a type of business structure that offers the best elements of a corporation to a broader range of newer and smaller companies. Under an LLC, your business operates as its own legal entity, meaning it carries debts and has legal protections apart from you as an individual. As the owner of an LLC, you can be a sole member or one of many, but you’ll enjoy the same pass-through taxation as a partnership or sole proprietorship along with some more traditional corporate benefits.

Perhaps one of the best elements of an LLC is the asset protection and flexible management it allows with regards to your business finances and taxes. Unless you need the full features of a corporation, you’ll be able to smoothly run your company without unnecessary complexities. For that reason, LLCs are particularly attractive to entrepreneurs who want to legitimize their business and establish it as a separate legal entity without the additional fuss. While becoming an LLC is often the best option for young and emerging companies, we recommend you explore all your options before committing to this route, as there are a few limiting factors that might affect the suitability of the LLC designation.

Licensing Your Business

Being an LLC may offer general legal and financial protections as well as provide your company with a certain competitive edge that boosts your professionalism. But having a business license is a totally different animal.

While an LLC operates on state statutes, getting a business license is much more specific. Licensees are authorized to operate in a geographical area — most commonly the county or city in which you are based. Depending on the nature of your business or your area, the process may involve additional requirements that you’ll have to meet before you can really get rolling. License requirements become more prominent for businesses that specialize in a potentially harmful, dangerous, or litigious field. For instance, if you’re planning to serve alcohol, sell weapons, or transport live animals across state lines, you’ll need specific licenses to accomplish these tasks legally.

Both federal and state licenses may be necessary, but state licensing rules vary greatly. So be sure to do your research — a great place to start is our Business License Search Tool. Even if you’re planning to operate a business out of your home, you might sometimes need a license depending on your product or services. There’s also the question of permits, which are even more specific than business licenses. They may not apply to you but look into this possibility first to ensure your company is in full compliance at all times.

Making Your Call

Hopefully, we’ve helped clarify how your LLC status and business licenses can each benefit your business. In the end, both are useful tools to build, protect and legitimize your operation in the eyes of the law and your customers. Somehow, the two have become conflated, but in actuality, they aren't actually that closely related. Whether you operate as an LLC or have the correct business licenses and permits are independent factors. Your company might very well operate best with both at your disposal — it all depends on your industry, the products/services you provide and your growth strategy.

Whatever you choose, Incfile is available to help you handle the tough decisions for your business. Our mission is to help you understand the business landscape and guide your company to succeed. We can even help do the research and get you all the business licenses you need. By empowering business owners like you with a deep well of resources, we help you become better equipped to pursue your goals with confidence so your company is built to last.