Your business name could be valuable, and not just to you. If another business owner wants to operate under the same or a very similar name to your business, you have the option of selling the name to them.

The approach you use to sell your name will vary depending on several factors, and we’ll cover the most important ones here. We’ll explore the process for selling your registered business name, the forms you’ll have to file, the tax implications of doing so and other areas you’ll want to think about.

Selling Your Business Name Is Not the Same as Selling Your Business Outright

It’s important to realize that you can sell your business name without selling the underlying business. If you do want to sell everything — your business name together with the business itself, your company assets and everything else, then we have some information that can help you. See our guides on “How to Sell a Business” and “How to Sell Your LLC or Corporation.”

For the rest of this guide, we’ll be focusing on just selling your business name but keeping the business it's based on.

Why You Might Sell a Registered Business Name

There are a few different reasons that you might choose to sell your business name:

- A new business or competitor is willing to pay you more than the name is worth to you.

- You are shifting the focus of your business and the current name no longer applies.

- Your business circumstances are changing and you want a new business name.

- The business name has significant importance for the individual who wants to buy it.

- The business name is highly marketable or has a good reputation.

Whatever your reason, the process for selling your business name is the same.

Considerations Before Selling Your Business Name

Here are some vital areas to think about before selling your business name.

Names for Sole Proprietorships and Partnerships Do Not Need to Be Unique

Depending on your state, multiple sole proprietorships or partnerships could share the same name. For example, you may have a “John Smith” working as a contractor in New York City, while another John Smith has a business named after them in Albany, NY. Likewise, you might have a “Smith and Johnson” accountancy firm in one city and a similarly named firm in another.

This means sole proprietorships and partnerships don’t generally have “name protection,” and therefore, there may not be a need to buy or sell a name of this type. Another sole proprietor or partnership could use the name without consequence — other than a potential confusion for customers that might mistake one firm for another. However, some states may restrict two sole proprietorships or partnerships from sharing a name, so it’s worth checking with your state’s business formation body.

Two Businesses May Have the Same DBA or Fictitious Business Name, Depending on Your State

All types of businesses can file a “Doing Business As” name, also known as a “Fictitious” or “Assumed” name. Rules for two businesses having the same DBA do vary between states, with some allowing two or more businesses to do business under similar or identical names and other states forbidding that. Check with your state’s business formation body on their rules for DBAs.

LLCs and Corporations Must Have Unique Names in a Specific State

Limited Liability Companies (LLCs) and corporations (S Corporations and C Corporations) must have unique names in each state they operate in. When you form an LLC or corporation, you can check to see if there is another business with the same name using our name search tool.

If there is, you’ll need to think of another name for your business. When you form your corporation or LLC, you are ensuring that no one else can have a similarly named LLC or corporation in your state.

A couple of important points here:

- This name exclusivity only applies to states where you have registered an LLC or corporation, either domestically or as a foreign business. You can have a “Blue Widgets LLC” in Colorado, and someone else can set up a “Blue Widgets LLC” in Texas.

- If someone else wants the same name (e.g., “Blue Widgets LLC”) in a state where you have that name, that’s typically when they would offer to buy the name from you.

Trademarked Names Are a Different Matter Entirely

There’s one step that business owners can take that turns everything we’ve covered above on its head — trademarking a name. Filing a trademark for a name with the U.S. Patents and Trademarks Office gives you the exclusive permission to use that name for a particular purpose — this might be in a specific industry or type of business.

This trademark protection applies across the whole of the U.S. and is not limited by state. This is one of the strongest reasons someone else may ask you to sell your business name — you own the trademark and they want you to transfer it to them.

How to Sell a Registered Business Name

Here are the steps to sell your LLC or corporation name.

1. Establish Your Rights to Sell the Business Name

Make sure that you have the rights to sell the business name. This will typically be the case if you registered the name of your LLC or corporation, and you’re the sole member or you have a controlling interest in the business. If you run the business with others, ensure you have their agreement to sell the name.

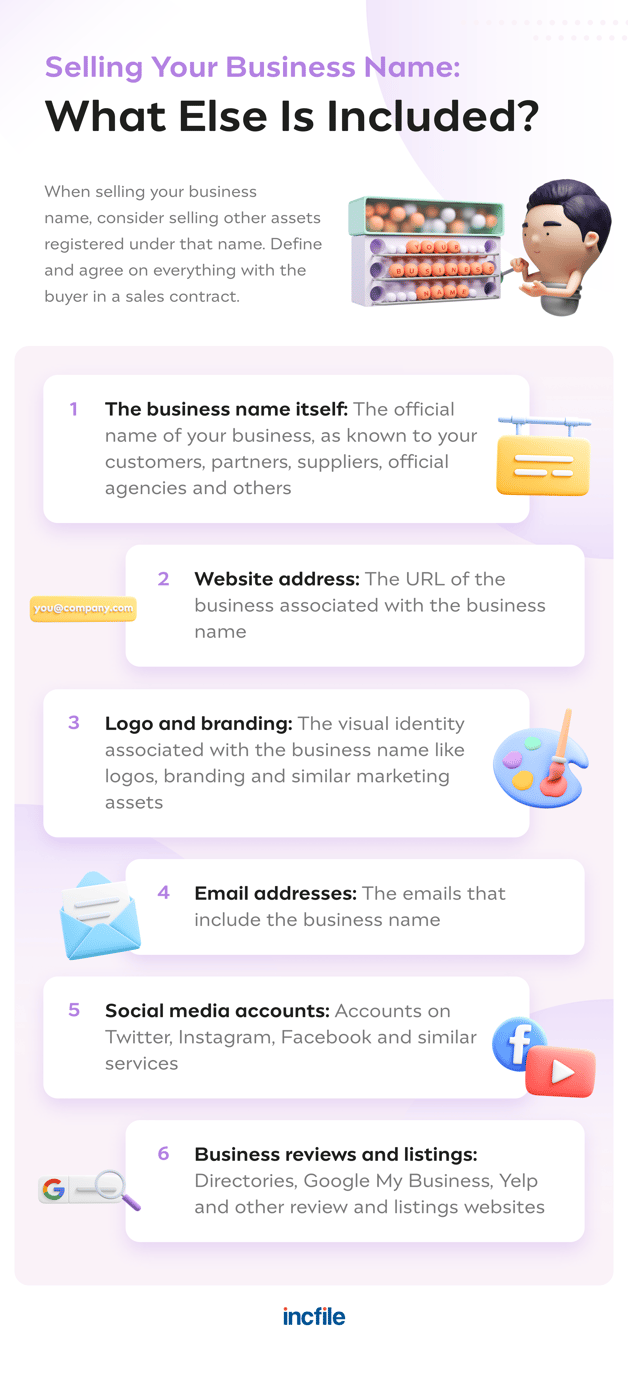

2. Define the Terms of the Business Name Sale

Negotiate the price, terms, assets and other aspects that will be included with the sale of the business name and agree on them with the buying party. This might include:

- The name itself

- Associated logos, branding and other marketing materials

- Web addresses, email addresses, social media account names and similar

- Access to the website, email, social media accounts and other technology

- Other business assets associated with the name

Once you’ve agreed to everything that you’re selling, ensure the complete assets, terms, prices and other aspects of the sale are drawn up in a contract or agreement. Engage a business attorney to put the right documentation together and check everything from a legal perspective.

3. Complete the Business Name Sale

Once you’ve agreed to the contract with all parties, you can complete the transactional part of the sale, move money as required and hand over the relevant assets.

4. Complete and Return a Transfer of Business Name Form

You will need to make the name transfer official with your state’s business formation body, normally the Secretary of State. Visit their website and search for a “Transfer of Business Name” form. Download the form and fill it in, including the names and contact details of the people selling and buying the business name.

Sign and date the form; you may also need to get it notarized. Then, return the form together with the relevant transfer or registration fee. You will be notified when the business name transfer has been completed.

5. If the Name Is Trademarked, Let the Trademark Office Know

You will need to inform the U.S. Patents and Trademark Office that you have transferred the trademark to someone else. The USPTO provides complete instructions on transferring trademarks.

6. Other Areas to Consider When You Have Sold Your Business Name

Here are some other areas to consider when you’re transferring a business name:

- If you’re using a DBA name, check with your state’s business formation agency on if you can assign the DBA to someone else. Rules do vary between states.

- If you’re keeping your existing business, you will need to assign a new name. Get the relevant form from your state business formation agency and complete the required steps to provide and register a new name.

- Notify your suppliers, partners, customers and others about the business name change, along with posting relevant updates to social media accounts and similar.

- Let the IRS and your state’s taxation agency know about the change of name.

- Update your business name with any other relevant federal, state, local or industry agencies or bodies.

- Update any business listings, directories or other resources with the new business names.

7. Pay Taxes on Your Business Name Sale

If you sold your business name at a profit, you will need to pay taxes. We have more information on that in the questions below.

Common Questions About Selling Business Names and Taxes

Selling your business name has tax implications.

What Tax Do You Pay When You Sell a Business Name?

Your business name is an asset, and that means if you sell it, you will probably have to pay taxes. You will need to establish any money that you spent to develop your business name and the purchase price. You’ll then need to understand if the sale will be taxed as regular income tax or as capital gains tax and incorporate the costs of intangibles like goodwill.

This means that the taxes on selling your business name can be complex, and it’s impossible to give general advice. Instead, we recommend consulting with a business tax attorney or accountant who can advise you on the sale of your business name. Incfile provides a tax and accounting service and our experts may be able to guide you in this matter.

How Do I Avoid Capital Gains Tax When Selling a Business Name?

If you sell a business name within a year of setting up your business, then it will be taxed as regular income, not long-term capital gains tax (CGT). Unfortunately, this means it will be taxed at a higher rate than CGT — not ideal! Otherwise, you are likely to pay CGT when you sell any business asset, including your business name.

So, there you have it. We hope you’ve found this complete guide to selling your business name to be helpful and that the new owner will make the most of the name and its reputation. Remember that if you need advice on your business finances, accounting and taxes, Incfile has you covered.