An EIN is a nine-digit federal Employer Identification Number assigned by the Internal Revenue Service (IRS) in order to identify your business for tax purposes. It's most often required if you're hiring employees, getting a business bank account, or getting a business license. Below, we'll show you how to get one, as well as answer a few common questions about Texas EINs.

How to Get an EIN in Texas

You can apply for a Texas EIN by filing Form SS-4 online or with paper forms submitted via mail or fax. Unironically, the snail mail method takes much longer, which is why the vast majority should apply for an EIN online. You can apply directly with the IRS through an online application session or opt to have a partner like Incfile help you navigate the process.

Here's what you'll need to provide to apply for your Texas EIN online:

Step 1: Legal Entity Details

The first step is identifying your business entity and providing information about its structure. This means selecting which entity type you operate your business as (sole proprietorship, partnership, corporation, LLC, estate, or trust).

After declaring your business type, you'll also need to state the number of members, the state in which your business operates or was legally formed, and the reason why you are requesting an EIN.

Note: If you haven't formed your business yet, Incfile offers helpful information and FAQs about forming a Texas LLC for your small business.

Step 2: Your Responsible Party

The second step is to authenticate your information and list the responsible party for your business. Your responsible party will go on file with the IRS as the point of contact for tax and other IRS matters. This designated person will need to provide their Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN).

The responsible party must be an individual, not a company, and if you've either formed or you're forming a single-member LLC, you will serve as the responsible party. If you have an LLC with multiple members, you can designate another member instead.

Step 3: Business Address Information

The third step is to provide the addresses relevant to your business. Here, you'll provide the physical address where your business is located — no P.O. boxes allowed. You can also choose to have any IRS mail sent to an alternate address if you choose.

Either way, the IRS will use this address to send relevant correspondence to your business, so it's important to make sure the information is correct.

Step 4: Name, DBA, State, and Other Details

The fourth step is to provide details about your business and its activities. This means listing the legal name of your business as well as your DBA (doing business as) name, if applicable, followed by the county and state and the date your business was formed.

You'll also be asked to answer a series of questions pertaining to situations your business may or may not encounter, including whether your business owns large trucks, semi-trucks, or buses or whether you manufacture or sell products such as alcohol, tobacco, or firearms.

Step 5: Confirmation, Summary, and Submission

The final step is to choose how you want to receive your EIN confirmation letter. The options are to receive it either by mail or online, but there's a big difference. Mailing your confirmation can take up to four weeks, while choosing the online option will produce your EIN confirmation letter almost immediately.

Finally, you'll review a summary of the information you've provided. Make sure to double-check all the details, and when you're ready, submit your application. Remember, if you chose to receive online confirmation, you can expect this in under two minutes.

What Is the Point of EIN?

Getting an EIN in Texas provides multiple benefits you can enjoy throughout the life of your business. Notable benefits include the ability to do the following:

- Open a bank account: Keep your finances separate with a business bank account.

- Build credit: Establish business credit to apply for business loans or credit cards.

- Hire employees: Onboard a team to help you deliver value to your customers.

- Get a business license: Apply for a business license and obtain any necessary permits.

- Build credibility: Increase your credibility and trust with your vendors and suppliers.

- Protect your info: Prevent identity theft by using your EIN instead of your SSN.

FAQs About Texas EINs

These are some of the common questions business owners ask about the EIN process. If you're wondering how to get an EIN number in Texas, they might be your questions, too.

How Much Does It Cost to Get an EIN in Texas?

Does an EIN cost money in Texas? If you're operating a business in Texas and need an EIN, you can apply for one for free through the IRS website. The process is fairly straightforward, and you'll need to provide basic information about your business, as mentioned above.

That said, if you need help navigating the application process or want to ensure everything is filled out correctly, you can work with a partner like Incfile.

How Long Does It Take to Get an EIN Number in Texas?

If you choose to apply for a Texas EIN via mail or fax, the process can take up to four weeks. This is because the IRS has to process the application manually, and there could be delays due to high volumes of applications or the far more frustrating issue of accidental errors on your form submission.

Applying online is the faster and more convenient option, and as long as you have all the necessary information on hand, you can receive your Texas EIN right away and start using it immediately.

How Do I Get a Texas EIN?

Obtaining an EIN can be as simple as filling out the online application and clicking submit. As noted above, you'll need to identify your business entity, authenticate with information about your responsible party, provide the address of either your business, registered agent, or another location (your home, perhaps), and offer specific details about your business including its name and the types of activities it engages in to turn a profit.

How Do I Get an EIN Number for My Paperwork?

To get an EIN for your paperwork quickly, you'll need to apply online through the IRS website. The application process is free, and you'll receive your EIN upon completion.

After you submit the application and it is processed, you'll receive your EIN number right away and can begin using it to file taxes, open a business bank account, and more.

Does an LLC Need an EIN in Texas?

A Texas LLC will be required to obtain an EIN if it meets a few different scenarios:

- You have employees.

- You operate your business as a corporation or partnership.

- You file Employment, Excise, or Alcohol, Tobacco, and Firearms tax returns.

- You withhold income taxes, other than wages, to a non-resident alien.

- You have a Keogh plan.

- You're involved in certain organizations, such as trusts, estates, real estate mortgage investment conduits, nonprofits, and more.

Even if your LLC has no employees, obtaining one is still recommended since there are several other benefits, as mentioned earlier.

Additionally, if you have a different business entity type and wish to change your business to an LLC in a way that requires you to dissolve your existing entity and form a new LLC, you'll need to apply for a new EIN.

Is a Texas Tax ID the Same as an EIN?

Not quite. The two numbers are different but equally important for tax compliance. An EIN is a federal number issued by the IRS for federal tax purposes, while a Texas tax ID is a unique number issued by the state of Texas for state tax purposes to businesses that are required to collect and pay state sales tax.

If your business sells taxable goods or services in Texas, you'll need a state-issued tax ID in addition to your federal EIN. To apply for a Texas tax ID, you'll need to file Form AP-201 with the Texas Comptroller of Public Accounts.

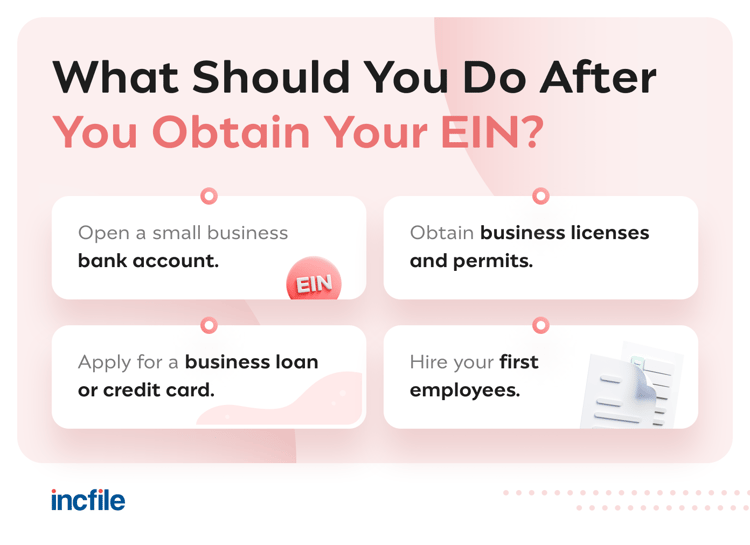

Next Steps: What to Do After Obtaining Your Texas EIN

After obtaining your Texas EIN, there are several important next steps that you should consider to help your business succeed:

Open a Small Business Bank Account

Once you've obtained your Texas EIN, one of the first things you should do is open a separate bank account for your business. This will allow you to keep track of your business finances and keep them separate from your personal finances.

Let's say that you own a small landscaping business in Texas. Opening a business account with a trusted bank will enable you to receive payments from your clients as well as pay your business expenses (such as fuel and equipment rentals) directly from your business account. This will make it much easier to file your taxes, pay yourself accurately, and manage your company's cash flow throughout the year.

Obtain Business Licenses and Permits

Depending on the type of business you operate in Texas, you may need to obtain certain licenses and permits to operate legally in your local municipality.

For example, if you plan to start a restaurant in Austin, you'll need to obtain a food service permit from the Texas Department of State Health Services and a liquor license if you plan to serve alcoholic beverages. If you want to operate a home-based business, you may need to obtain a home occupation permit from the City of Austin.

Obtaining the necessary licenses and permits is an important step in avoiding troublesome legal issues that could significantly harm your business reputation, and an EIN is often required to get them.

Apply for a Business Loan or Credit Card

If you need funding to start or grow your small business in Texas, you might consider applying for a business loan or credit card, which you can do with your new EIN.

If you own a small e-commerce business in Texas, for example, and need to purchase additional inventory, you could apply for a business loan from a bank to stock your shelves. You could also apply for a business credit card to cover any ongoing or monthly business expenses.

Your EIN enables you to start building business credit, which also helps streamline these applications.

Hire Your First Employees

Once your business grows, you may need to hire employees to help you manage your day-to-day activities. However, hiring employees comes with legal and financial responsibilities.

You will need to obtain workers' compensation insurance, withhold taxes from your employees' paychecks (you'll need an EIN for this), and comply with federal and state employment laws. You'll also need your Texas EIN to file payroll taxes on a regular basis and provide your employees with their W-2 forms at the end of the year so they can file correctly as well.

Need a Texas EIN for Your Small Business? Incfile Can Help

Learning how to get an EIN number in Texas is just one step of many to forming a legal business entity. Business formation needs to be done correctly to avoid setbacks, compliance issues, or risks to personal assets. Incfile can help you form your legal entity and take care of the steps in getting your Employer Identification Number.