The Employer Identification Number (EIN) functions like a Social Security number for your business in that it identifies your business entity with the government for tax purposes and is required if you plan on hiring employees.

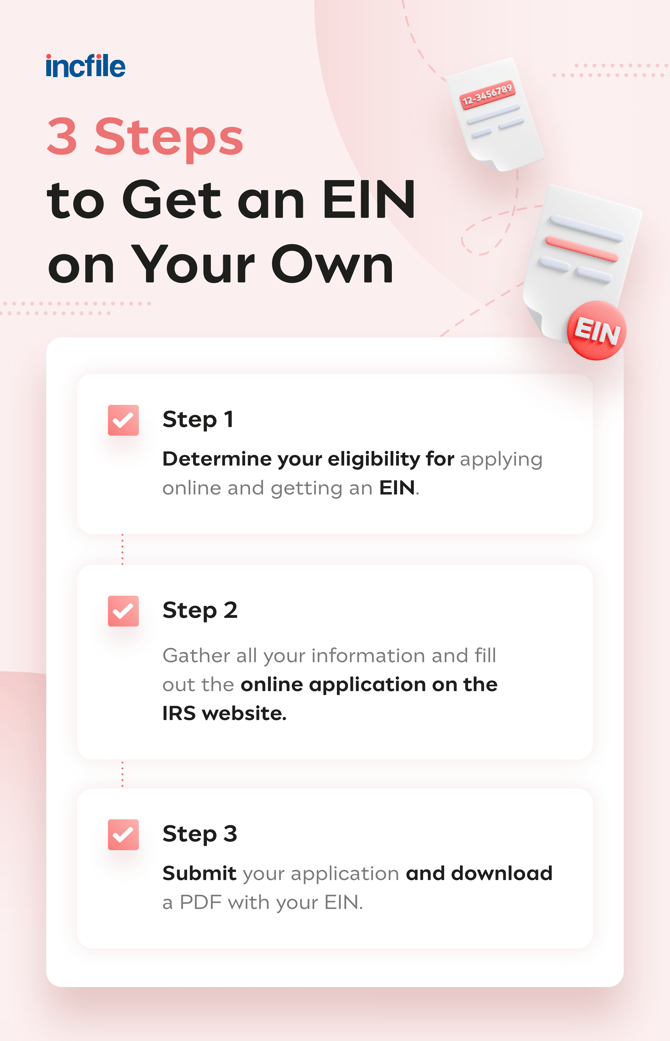

It’s important to obtain your EIN soon after starting a business so that you can keep on track with your taxes. We can help you through the process, or if you'd like to get an EIN for your business on your own, here's how to do it in three steps.

How to File for an EIN Number

It's important to dedicate a solid chunk of time to filing your EIN if you decide to do it on your own. Before you apply, you will need to determine which forms apply to your business, what business information you'll need, and how you want to file (online, by mail, or fax). Once you're ready, follow these steps to get your EIN number.

1. Determine If You're Eligible to File

According to the IRS, you are eligible for an EIN if you have a business that is located in the United States or its territories and if you have a valid Taxpayer Identification number (like a Social Security number). If you meet those two requirements, then you are eligible to get your EIN. You can only get one EIN per responsible party per day.

2. Apply Online for Your Business' EIN

There are a few ways you can apply for an EIN for your business: online, by mail, or by fax.

Online

The IRS EIN application is available online. If you are applying for an employer identification number online, make sure to have the information you need at your fingertips. You must answer all questions on the application in one session, as your info will not save partially. After verifying your online application information, you can choose to immediately download a PDF with your EIN or have the EIN mailed to you.

By Mail

You can also choose to file by mail. To do so, you'll need to fill out Form SS4. According to the IRS, the processing timeframe for an EIN application that is received by mail is three months. This can be delayed if the form is not legible or complete. In recent years, delays have been reported due to staffing shortages at the IRS.

By Fax

Believe it or not, you also have the option to fax your completed Form-SS4 to the IRS for processing. The IRS estimates that the processing time for processing forms received by fax is four business days. You can find the right fax number and mailing address on the IRS website, "Where to File Your Taxes (for Form SS-4)."

3. Submit Your Application and Get Your EIN

Here is the information needed for the IRS EIN application:

- The legal structure of your business, i.e., LLC, corporation or a trust

- Depending on the legal structure of your business, the application will then ask you details, such as how many members are in an LLC, the type of corporation, if you are a CEO, etc.

- Next, you will need to provide your Social Security number.

- You will then need to provide your address and your business address, any DBAs you've filed for the business, and the date your business was started.

- The IRS will then ask a series of questions about the type of business you do, such as if you plan to sell firearms, tobacco or alcohol; if your business owns any motor vehicles; if your business will have employees who file a W-2; and if you will file a Form 720 (Quarterly Federal Excise Tax Return); plus other questions about your industry.

- After you have input your business details, then you will choose how you would like to receive your EIN number. You can choose to download it immediately, or you can choose to have it mailed to you.

How Easy Is It to Get an EIN Number?

It depends on how much time you have. The process for obtaining an EIN number for your business on the IRS website takes about 10-20 minutes, if you have the necessary paperwork at hand. Remember, you must complete the application in one session. You will not be able to save your progress and return later. For security reasons, your session will expire after 15 minutes of inactivity.

Additionally, the IRS recommends you install Adobe Reader before beginning the application, if you don’t already have it on your computer. That is because the EIN number can be immediately downloaded after you finish the application in PDF format.

You will get your EIN immediately upon completion. You can then download, save, and print your EIN confirmation notice. You may also choose to have a hard copy letter with your EIN number mailed to you.

How Much Does It Cost to Set up an EIN Number?

It is free to set up an EIN number on your own with the IRS. The IRS EIN application does not require any payment details whatsoever, and you will receive your EIN quickly after you complete the application and verification process. Some professional services, including Incfile, offer packages that will obtain an EIN on behalf of your business.

Incfile EIN Package

If you are too busy to dedicate time to applying for an EIN for your business or have trouble keeping track of important documents, then this might be a smart choice for you, especially since retrieving a lost EIN can be a lengthy process. Incfile's convenient service will help you apply for an EIN online and obtain your number typically within just one day.

Just submit your phone number and email address, and we’ll contact you with a few questions. We file on your behalf with the IRS, email you your EIN when it's ready, and then, securely store your business' EIN for you in your Incfile dashboard so you never lose it. (And remember, once you have an EIN, it will never expire.)

Do I Need an EIN to Start a Business?

If you own a sole proprietorship or LLC that has no employees, you do not need to get an EIN for your business. That said, in order to do any of the following, you will want an employer identification number:

- To file tax returns for your business

- To open a business bank account in your business’s name

- To open a business credit card or obtain a business loan (often required)

- To pay your employees

- To help establish credit for your business

- To help maintain your business’s standing as a legal business entity