As a business owner in the Golden State, there are certain things you need to stay on top of — one of which is filing an annual report.

Follow our instructions on how to file a California annual report. We also have information on due dates, filing fees and form requirements.

What Is an Annual Report?

In California, an LLC annual report is known as a Statement of Information. An easy way to understand annual reports is to think of them as a "check-in" or "status update" from the state about your business.

Does your business still operate? Is it operating from the same business address? Are the same LLC members still on board?

This is the type of information the California annual report collects.

The Statement of Information is public records and it keeps the state authorities, public and investors informed about your business and its finances.

Do I Have to File an Annual Report for My LLC in California?

You surely do! According to California statutes, all LLCs, nonprofits and Corps registered in the state are required to submit an annual report — also known as a Statement of Information.

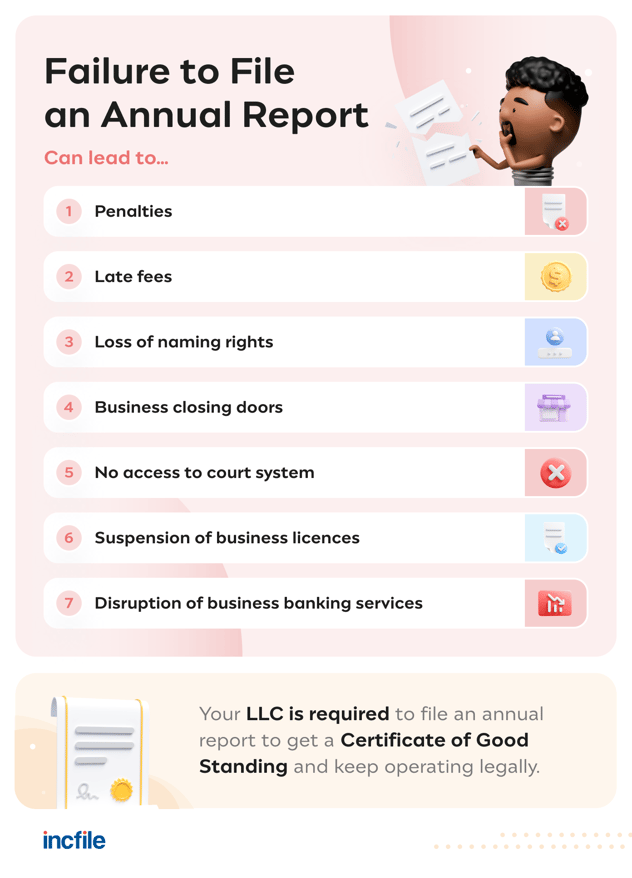

What does this report do? It keeps your business in good standing and allows you to continue to operate. Failure to file annual reports on time can result in late fees and or having to close the shutters (oops!).

How to File California Annual Report

There are three steps to go about filing the California LLC Annual Report.

1. Locate the Statement of Information Form on the Secretary of State Website

If you wish to file online, head to California's BizFileOnline portal.

A hard copy of the form is also available, which you can print, complete and mail in.

2. Gather All the Required Information

California's Statement of Information requires the following details:

- Company's legal name (should be an exact match to LLC formation paperwork)

- 12-digit state entity (file) number — this is stamped on top of your LLC's registration papers by the Secretary of State or can be found via a business entity search

- Business address

- Members' names and contact information

- Registered Agent (Agent for Service of Process) information

- Description of business

3. File Online, In Person or Via Mail and Pay Fees

To file online, you'll need to:

- Go to the BizFileOnline Portal and click on "File Online" option.

- Search for your business by its official name.

- Click on the name and follow the filing prompts to complete the form.

- Pay the associated fees using a credit card.

Hardcopy of forms, along with a check or money order, can be submitted in person or mailed to the following address:

Secretary of State, State of Information Unit

Business Programs Division Business Entities

P.O. Box 944230

Sacramento, CA 94244-2300

If you wish to physically drop off the form, head to:

1500 11th Street

Sacramento, CA 95814

California Annual Report Due Date and Fees

For LLCs, the initial Statement of Information is due within 90 days of filing your formation paperwork.

After that, you can submit the form biennially, meaning every two years.

California mandates a $20 filing fee for LLC Statement of Information. If you want an actual Certificate of Good Standing, then it costs an additional $5.

|

Form Name

|

Filing Frequency

|

Filing Date

|

Filing Fee

|

|

Statement of Information

|

Biennially

|

First form within 90 days of registration

After that, it's due on last day of the formation month

|

$20 + $5 for certificate (optional)

|

We'd like to point out that state agencies aren't the best at sending constant reminders about the deadline for the annual report. In most cases, you'd be tracking this on your own.

Incfile's Annual Report service allows you can offload this filing completely. Simply provide us with your information and let us know if there is any change; we will track submission dates and forms and file on time, every time on your behalf.

California Annual Report Filing FAQs

Still have some lingering questions? No worries — we have rounded up and addressed some of the most common questions regarding California's annual report.

What happens if I miss my annual report filing date?

The state of California gives you a 60-day grace period before applying a $250 late fee.

If you fail to file post this grace period, your business's authorization to operate might get revoked.

How long does it take to process the Statement of Information?

Online filings are generally processed within two or three business days. In-person or mailed submissions are processed within one to two weeks. Current processing times are available on the Secretary of State website.

Do I still need to file California Annual Report if my business is new?

Yes, if you are a newly formed business, you need to file the first Statement of Information within 90 days of registering your business.

What is the filing due date after the initial 90-day filing?

After you have filed the first report, the annual report is due on the last day of your formation month.

For example, if you registered your business on February 20, 2020, your initial 90-day Statement of Information was due on May 20, 2020. After that, the next filing was due on February 28, 2022, and then again on February 28, 2024 (every two years or biennially).

What do I do if my business has closed down? Do I still need to file an annual report?

To formally dissolve your business, you need to file the appropriate paperwork with the Secretary of State portal within 12 months of the company's final tax return. Once you have done that, you no longer need to file the annual report.

However, if you haven't officially dissolved the company, you need to continue to file the annual report.

Incfile can help you complete the dissolution paperwork, so it's one less thing you have to worry about.

Manage Your Filings with Incfile

Keep your state informed on your business's activities and avoid penalties or the possibility of business closure by filing your California annual report on time.

Entrust Incfile to handle all your LLC's annual report filings. By doing this, you won't have to remember dates, applications or changing state requirements. You can stay focused on keeping your business going and growing — stress-free.