If you own a business in the great Sunshine State, there will likely come a time when you'll need to hire employees and make things more official with your bank and tax authorities. One important step is to add an EIN to an LLC in Florida. It's free to do, though companies such as Incfile offer affordable packages that will take care of the process on your behalf so that you can focus on running your business. For just $70, Incfile can complete the steps to obtaining your EIN. But what is required to add an EIN to an LLC in Florida?

According to the Internal Revenue Agency (IRS), after you complete and submit the required paperwork to add an EIN to your Florida LLC, processing time takes four weeks if the application is sent via standard mail. Or, you can apply online with the IRS for instant approval.

EIN Basics

LLCs are required to apply for and obtain an EIN in order to commence certain activities within their business, but if you need a complete understanding of what an EIN actually is or what it can do for your business, let's set the record straight.

What Is an EIN?

An EIN is a nine-digit Employer Identification Number issued by the IRS when a business owner submits IRS form SS-4. It is essentially a tax identification number (often referred to as a tax ID number) that your business needs for a few activities. Here are a few examples:

- Hiring employees. In order to do payroll and withhold payroll taxes for any employees you wish to hire, you'll need to provide your EIN to get your payroll system set up. Your EIN will be used on tax returns as well as any other documents that are submitted to the IRS.

- Purchasing inventory that you intend to resell. We're all accustomed to paying sales tax on products that we purchase, but if you're a business buying goods for resale, you don't want to be paying sales tax, right? Your EIN acts as proof that you're a business, and in many states, you won't have to pay their sales tax.

- Opening business bank accounts. Banks will require your EIN in order to open accounts or approve business loans. Your EIN proves that you are banking on behalf of your business, and not yourself, and separate bank accounts for business finances and personal finances make everything far more simple at tax time (as well as separating liability, which is a big reason for forming your LLC in the first place).

- Establishing business credit. If you need funds to start, scale, or otherwise grow your business, your LLC may need to borrow from the bank. If so, you'll need an EIN in order to establish and build the credit necessary for approval. We all know that banks don't just hand out cash to anyone in a flashy suit with a briefcase.

- Filing certain taxes with the IRS. After all, when you add an EIN to a Florida LLC, it's the IRS doing the issuing. Your LLC doesn't need an EIN to file basic taxes, but if you have employees or are required to file any excise taxes, you'll need it. Here's one example from the IRS, which states:

"A single-member LLC that is classified as a disregarded entity for income tax purposes is treated as a separate entity for purposes of employment tax and certain excise taxes. For wages paid after January 1, 2009, the single-member LLC is required to use its name and employer identification number (EIN) for reporting and payment of employment taxes. A single-member LLC is also required to use its name and EIN to register for excise tax activities on Form 637; pay and report excise taxes reported on Forms 720, 730, 2290, and 11-C; and claim any refunds, credits and payments on Form 8849."

- Preventing others from assuming your identity. Identity theft is no joke, and it happens more often than we think. Whenever your business does business with another business, you can provide your EIN instead of giving out your Social Security number. This means that when you add an EIN to your Florida LLC, you can keep your number private, confidential and secure.

- Adding credibility to your business. When your LLC takes on a new client, they'll provide you with a 1099 tax form to complete. Unless you have an EIN, you'll have to provide your personal Social Security number. Aside from the identity theft risk mentioned above, this could make your business appear less legitimate. An EIN tells your clients that you are a serious, credible business.

Who Needs an EIN?

If you're a sole proprietor forming an LLC in Florida, do you need an EIN? How about if you already have an LLC in Florida? Your EIN is used for conducting numerous business activities revolving around taxes and the IRS. If you're a sole proprietor without employees, you are still eligible to get an EIN, but it isn't required. If you plan to hire employees, open bank accounts, or do any of the activities mentioned above in the state of Florida, you will need to complete IRS Form SS-4 and add an EIN to your Florida LLC.

In general, it makes sense to get an EIN for your business regardless, as it is inexpensive (or free if you handle the application and submission process yourself) and offers the multiple benefits discussed.

How to Get an EIN for Your Florida LLC

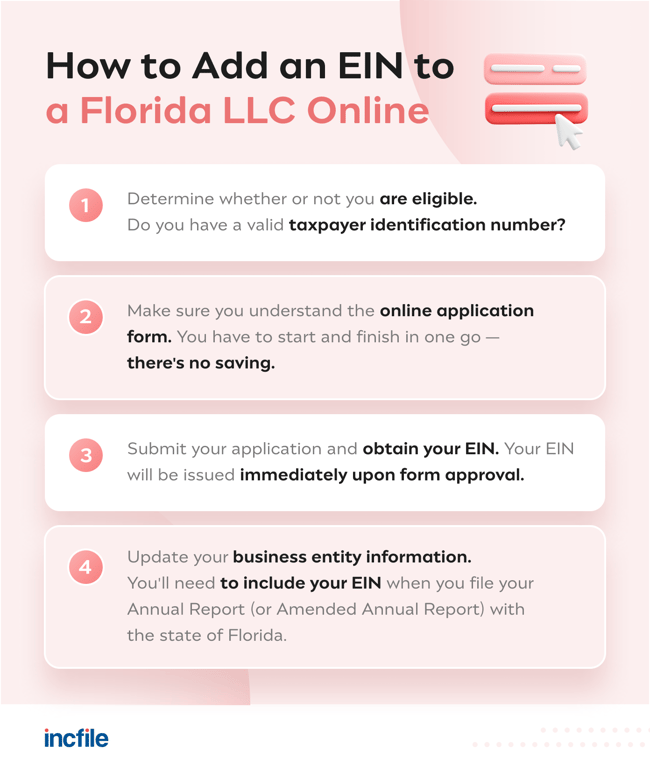

If you need to add an EIN to a Florida LLC, you can follow the steps and submit your application. Here's how:

Step 1: Determine Your Eligibility for an EIN

Principal businesses located within the United States or a territory of the United States are able to apply for an EIN using the online application system. Whomever physically submits the online application is required to have a valid Taxpayer Identification Number, which can either be a Social Security Number (SSN), an Individual Taxpayer Identification Number (ITIN), or an Employer Identification Number (EIN) of their own.

You'll also need to indicate an EIN-responsible party (only one per day) who either has ownership or control (or effective control) over the LLC. If your business is not a government entity, the EIN-responsible party must be an individual person and not another registered business entity.

Step 2: Fill Out the Online Application

Make sure that you have adequate time to complete the application and that you've gathered all relevant information in advance. The application session will expire if you're inactive for 15 minutes, and as there is no saving, you'd need to start from the beginning.

When you first begin the application, you'll be asked to indicate the type of business entity you need an EIN for (pursuant to this article, you'll choose "LLC") as well as the state (Florida) and how many members your business has. Then, you'll need to choose the reason for applying — either starting a new business, hiring employees, banking purposes, changing the type of organization, or purchasing an active business.

The application will then request information for your responsible party in order to authenticate your information with IRS records before moving on to your business address and a few other details. At the end, you'll confirm and submit.

Step 3: Submit Your EIN Application

After you've input all of your information correctly, you can proceed to submit the application. Once you do, the system will validate your information as it was recorded and, if successful, issue an EIN immediately. With your brand new EIN displayed on the screen, you can download or save it or choose to print the confirmation notice for your records.

Either way, you'll want to keep this number handy so that you can take advantage of its benefits and have easy access when it's required for IRS filings and other business activities.

Step 4: Update Your Business Entity Information

The State of Florida requires LLCs to update their business information when filing either their annual report or amended annual report. Updates are required if there are any changes to your email or mailing address, manager or office address changes, or when you add a new EIN.

If you formed your LLC before January 1 of the current year, you can file your report with the state and include your EIN, but if you formed your LLC after January 1 of the current year, you'll include your EIN when your next annual report is due.

Options for Submitting Your EIN Application

- Do-it-yourself. You can complete the application process on your own by gathering all of your information, following our steps above, and ensuring that your application is complete and submitted via the correct channel to the IRS. It may be a little time-consuming, but for those DIY business owners, this may be the preferred option.

- Purchase an EIN package. For a low fee, you can have a reputable service provider complete the process on your behalf and you won't have to lift a finger besides providing some pertinent information. This is often a good choice f you aren't completely sure about the process or if you're a non-U.S. citizen.

Many small business owners find that there just aren't enough hours in the day to complete all that they need to do, which is why companies such as Incfile provide a comprehensive service. Not only does it save small business owners valuable time, but it helps to eliminate application errors or confusion surrounding the submission of documents.

How Much Does It Cost to Get an EIN in Florida?

The IRS receives applications at no cost, so it's just a matter of setting aside the time to get the paperwork done. If time is valuable, then there is a time cost to consider. If you choose to add an EIN to your Florida LLC with the help of a service provider, you can expect the cost to be fairly low. Incfile will complete the entire EIN process and submit it electronically for $70.

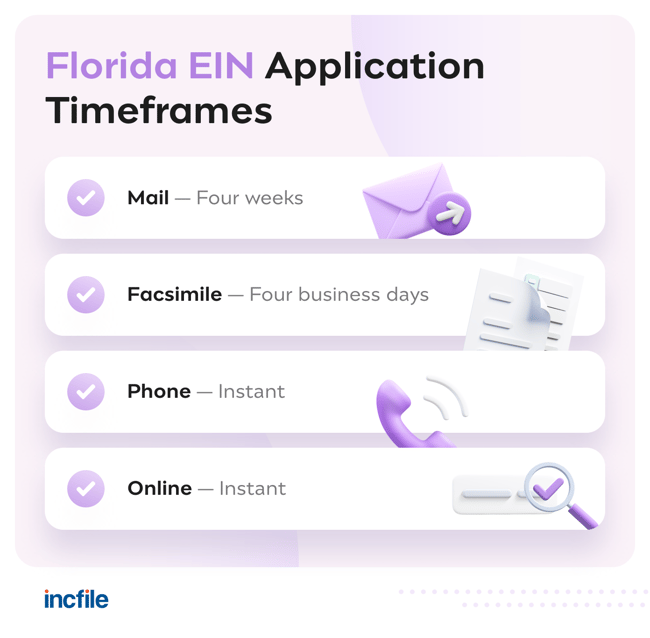

How Long Does It Take to Get an EIN in Florida?

If you decide to do it yourself, you can download the IRS form SS-4. There are four ways you can submit your paperwork:

- Mail. If you aren't in a rush, you can apply to add an EIN to an LLC in Florida by mail. The processing time indicated by the IRS is four weeks.

- Fax. People still fax, right? If you want to fax your application and provide a return fax number, the IRS will issue your EIN and fax it back to you within four business days.

- Phone. If you're a non-U.S. citizen and wish to apply internationally, you can call the IRS at (267) 941-1099 and provide all of your details over the phone. The IRS will review your information, assign the nine-digit number, and provide your EIN while you're on the call.

- Online. This is the most popular option because it's faster than the other methods and familiar to those who spend a solid amount of their time using a computer. Online applications are validated during the active session and, once approved, will produce an EIN number immediately.

Need to Add an EIN to a Florida LLC? Incfile Can Help

Obtaining an EIN for your LLC not only makes it possible and easier to operate your business legitimately, but it also offers benefits that can help you and your business succeed. At Incfile, that's exactly what we want to see happen, and we're ready to partner up whenever you are. Our formation services don't just stop at incorporation, and our EIN service is just one of the many ways that we help small business owners navigate their tax and legal obligations to ensure there are no hiccups or lost time.

Add an EIN to your Florida LLC with Incfile today and receive your nine-digit Employer Identification Number in just one business day.