Texas is considered one of the best places in the country to start a business and many already established companies in other states are making the move, including Tesla, Oracle, Chevron and dozens more. Its low tax burden, centralized location and affordable cost of living are some of the reasons why its seen robust business growth. On its own, Texas has the ninth-largest economy in the world, with a growing labor force of over 14 million workers. In 2021 alone, the state has added 694,400 new jobs.

To start a business, you'll need to know the ins and outs of getting a business license in Texas. Here are all the details you need.

Do You Need a Business License in Texas?

Texas is a pro-business state offering a welcome environment to in-state entrepreneurs and out-of-state business owners looking to relocate. In order to conduct business in the state, companies will need to register with the Texas Secretary of State. They will also need to apply for their Tax Registration Application, referred to as the Seller's Permit or Sales Use and Tax Permit.

Unlike many of the other 50 states that have business licensing requirements, a general license is not required to conduct business in Texas. However, depending on the type of business, companies may need to file for job- and industry-specific permits, licenses and certifications in order to operate legally in the state. Licensing can range from running an accounting firm and operating vending machines to owning a winery.

There are over 300 business types in Texas, and each of these businesses will have different requirements that they must follow. It is important to know which licenses and permits are applicable and to consult with the proper regulatory agencies that oversee these activities. Depending on the industry, there may also be requirements for renewal or recertification.

Types of General and Federal Business Licenses in Texas

Though there are hundreds of business types that will need to have a business license or permit to operate, not every business that forms in Texas will need a business license. It all depends on the business and the services offered. One of the most common permit requirements are Air Permits, which are granted by the Texas Commission on Environmental Quality. Examples of businesses that will need this type of permit include abrasive blast cleaning, auto body/repair shop, cleaning/janitorial service, crop dusting, distillery, general manufacturing and mining operations.

Sometimes, however, a license may be more clearly defined and attached to a profession — for example, a locksmith would need a locksmith license and a water/well drilling company would need a water well driller and pump installer’s license. Other businesses and professions do not require a state license, such as a travel agent.

To legally run a business in Texas, it is important to acquire the proper federal, state and local licenses and permits.

Federal Licenses and Permits

For businesses that offer services and activities regulated by the federal government, they will require federal licenses and/or permits. A prime example of this scenario would be gun sellers and operators of shooting ranges. These types of businesses would require approval from the U.S. Department of the Treasury Bureau of Alcohol, Tobacco and Firearms. Other businesses or industries that will require federal licenses include:

- Agriculture

- Aviation

- Alcohol Sales

- Fish and Wildlife

- Commercial Fisheries

- Mining and Drilling

- Nuclear Energy

- Television and Radio Broadcasting

- Transportation

State-Wide Licenses

In addition to obtaining a Sales Use and Tax Permit, many businesses and professions will require specific licenses granted by the Texas Department of Licensing and Regulation (TDLR). These can include:

- Accounting

- Acupuncture

- Athletic Trainer

- Child Care/Day Care

- Dietician

- Electrolysis Services

- Interior Design

- Nursery/Florist

- Property Management

City and County Permits

Some cities and municipalities may tack on additional requirements and permission authorizations on a local level. Examples where this would be required include:

- Building/Home Occupancy (commercial and residential)

- Tree Planting/Removal

- Demolition

- Signage

- Food Services (in addition to state permits)

- Special Events

- Zoning

- Mobile Retail (non-food)

Popular Industries in Texas That Require a State License or Permit

Source

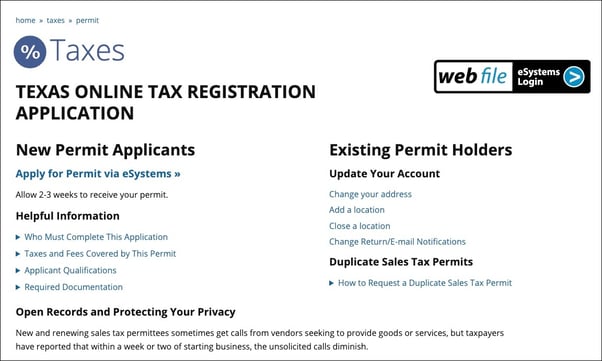

Steps for Obtaining Your Sales Tax Permit Application

Before you can apply for a business license in Texas, you’ll need to have completed the process of forming your Limited Liability Corporation (LLC) or corporation or nonprofit. The information provided by your formalized business entity will be required for the completion of your business license.

Step 1: Gather Your Information

Having an LLC, corporation, nonprofit or sole proprietorship means that you already have this information available, so all you need to do now is add it to your Texas sales permit application. For that, you will need the following:

- The name of your business

- Your business address and phone number

- Your business type (LCC? Corporation? Partnership?)

- An Employer Identification Number (EIN)

- The certificate of insurance for your business

- A business plan

Step 2: Complete and Submit Your Sales Tax Permit Application

- Create an account.

- Fill out the sign-up information, review and continue.

- Submit your application.

Applications can be submitted by mail or delivered in person to the local municipality or county offices. Completing an online application, however, will result in a faster turnaround time that may take just a few days to a week to receive approval. Applying in person at a physical office can lead to a 2-3 week approval timeline.

Steps for Obtaining a Business License or Permit in Texas

As we mentioned earlier in this article, Texas does not require a general business license. That doesn’t mean, however, that you’re off the hook for looking into business-required licenses or permits. The best place to begin your search for these industry or activity-specific licenses and permits would be with the state’s permit office or to hire a professional service to help research and navigate through the maze of offices and websites.

The cost of a business license in Texas can range from $30 to $50 on the low end to hundreds of dollars, depending on the type of permit or license. For example, dwelling and zoning permits can be as high as several hundred dollars or more. It is also important to keep in mind that license and permit fees are not refundable in Texas.

Renew Your Texas Business License or Permit

Depending on the county and agency where you applied for your license, renewal times can vary, but for the most part, licenses in Texas are renewed yearly, with some being renewed every two years.

For most licenses and permits, you can renew online by visiting the Texas Department of Licensing and Regulation (TDLR) website. There, you will be able to renew everything from an AC and Refrigeration to a Used Auto Part and Recyclers license. In addition, the TDLR site will also allow you to update your contact information, order a duplicate license, request receipt of online renewal and even pay fees and penalties online.

Here are some important things to know about renewing your licenses and permits:

- A business license’s expiration date is the last day of the month preceding the license's issuance.

- It is recommended that business owners renew 90 days before the license expires.

- Failure to renew your license or permit will put your business at risk and will force you to pay fees and penalties as well as lose potential business.

Do Home-based Businesses and Online Sellers Need a Business License?

Whether you are working in an office building, a neighborhood café or on the couch from home, you will need to have a Sales Use and Tax Permit for your business. This will allow you to legally sell products or services in Texas. Depending on the municipality where you run your business, you may also need to have a local business license and have your business registered, and that includes whether you’re operating a sole proprietorship or single-member LLC.

The Sales Use and Tax Permit will allow you to collect sales taxes on the goods and services sold. In return, these taxes will need to be reported to the state and federal government either quarterly or in total at tax time. Sales tax rates will vary depending on the city or county.

Although not required, having an EIN for your small business is helpful when it comes to organizing your finances, including opening up a bank account and itemizing your cost and separating expenses from personal assets when taxes are filed.

Finding the Right Business License Package

Making sure that you have the proper business licenses and permits is critical to running your company without running afoul with any federal, state, or local requirements. For a better understanding of what you may require for your business, check out Incfile’s Business License Research Tool. It’s a useful resource and easy to navigate. Just select your state — Texas — and scroll through the industries on the right column to check and determine your requirements.