You've formed your California LLC and you're enjoying running a business in the Sunshine State. Your official business paperwork is all done, right? Actually, no.

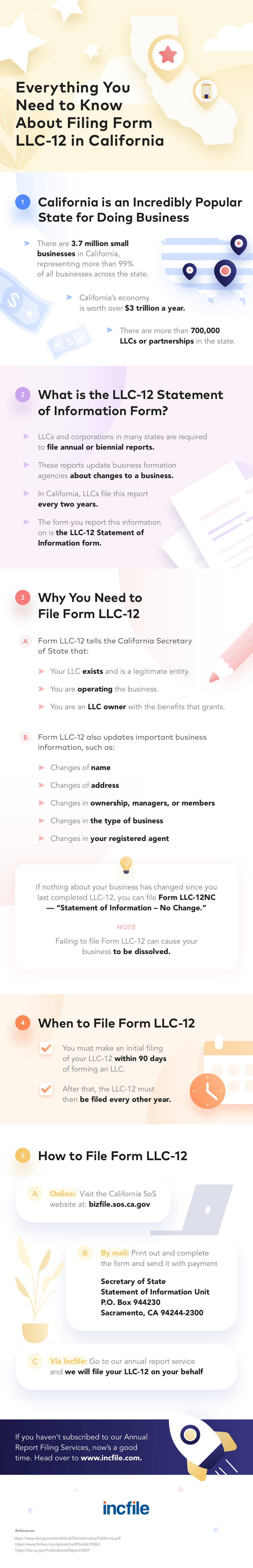

When you first start your business and form an LLC in California, you file Articles of Organization to officially “create” your business as a legal entity. But once you have started your business, you also need to manage ongoing business filings with the state of California. This type of filing is called an annual report or biennial report, depending on the state; in California, LLC owners must file a report every other year called a Statement of Information, also known as form LLC-12.

Learn more about when you must file a Statement of Information (Form LLC-12) for your California LLC, and why these ongoing business filings are important for your business compliance.

What Is a Statement of Information in California (Form LLC-12)?

In California, owners of LLCs are required to file a special document with the California Secretary of State’s office called a Statement of Information, or Form LLC-12. This is a form that helps establish the legality and validity of your business by registering certain details with the state.

Along with filing your Articles of Organization to start your LLC in California, Form LLC-12 is required to show the state that your business exists, that you are operating a business and that you are in good standing with the state regulatory authorities. It proves that your business is a legitimate entity and that you as the LLC owner deserve to keep enjoying the benefits and personal liability protections of an LLC.

In case there are any changes to your business, such as a change in the business address, change in ownership or business leadership, change in the type of business or other relevant details, you are required to update the state on these changes by filing a new Form LLC-12. The form also includes details about who is authorized to receive service of legal process on behalf of your LLC, whether it is you as the business owner or whether you designate a Registered Agent to receive those formal notices or official mailings.

When Do I Need to File Form LLC-12?

In general, there are two occasions when you need to file Form LLC-12 for your California LLC:

- Initial filing within 90 days of forming your LLC and filing Articles of Organization: The state requires you to file a Form LLC-12 “Initial Filing” soon after starting a new business, so you can officially inform the authorities of your business mailing address and other key details.

- Periodic filings every 2 years after that: The Form LLC-12 is a biennial report; the state of California requires you to file Form LLC-12 every two years, depending on the date when you registered your LLC for the first time. If you registered your LLC in an odd-numbered year, then your Form LLC-12 will be due in odd-numbered years; if your LLC was registered in an even-numbered year, you will need to file Form LLC-12 in even-numbered years too.

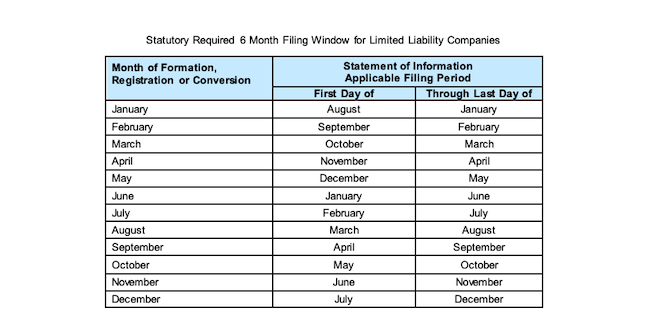

California allows for a six-month filing window for Form LLC-12’s ongoing periodic filings. This means that your deadline for filing your Form LLC-12 is somewhat flexible; you have the full month of the two-year anniversary of when your business was registered, along with the five months prior to that month.

For example, if your LLC was formed in June 2019, that means your LLC-12 is due in June 2021. And you can file your Form LLC-12 during January 2021 through the last day of June 2021. If your LLC was formed in January 2020, your LLC-12 is due in January 2022, and you can file it anytime during August 2021-end of January 2022.

What Information Is Included on Form LLC-12?

Full details for Form LLC-12 are available at the California Secretary of State’s website and you can read the full form details and instructions here (PDF version).

The form requires you to fill out the following pieces of information:

- Name of the LLC

- Entity number (assigned to the LLC by the California Secretary of State)

- Business Address(es)

- LLC manager(s) or member(s)

- Agent for Service of Process (the individual or corporation providing your Registered Agent duties)

- Type of business (describing the LLC’s type of business or services)

- CEO information

How Do I File Form LLC-12?

Form LLC-12 can be filed online at bizfile.sos.ca.gov. If possible, the state encourages you to file online for faster service.

If you want to file the form on paper, you can print a copy of the Form LLC-12 PDF from the California Secretary of State’s website and send in the completed form with payment to:

Secretary of State

Statement of Information Unit

P.O. Box 944230

Sacramento, CA 94244-2300

Or deliver it in person (drop off) to the Sacramento office: 1500 11th Street, Sacramento, CA, 95814.

What If There Aren’t Any Changes to Report?

If all of the details about your business are exactly the same since the last time you submitted Form LLC-12, you can fill out form LLC-12NC (“Statement of Information – No Change”).

What If I Haven’t Done Business or Filed In a While?

In order to file Form LLC-12, the LLC status must be listed as “active” or “suspended/forfeited” on the official records of the California Secretary of State. If you haven’t filed your LLC-12 in several years, your entity may be suspended or forfeited on the records of the California Secretary of State. The status of the LLC can be checked online on the Secretary of State’s Business Search at BusinessSearch.sos.ca.gov.

If the LLC’s status is suspended or forfeited, the status must be resolved with the California Franchise Tax Board (FTB) for the LLC to be returned to active status. To resolve this problem, go to the FTB’s website or contact the FTB at 800-852-5711 (from within the U.S.) or 916-845-6500 (from outside the U.S.).

How Much Does It Cost to File LLC-12?

Filing your LLC-12 form costs $20. If you need additional certified copies (for other members or investors, for instance), copy fees are $1.00 for the first page and $.50 for each attachment page. For certified copies, it is an additional $5.00 fee per document.

Can I Be Penalized for Not Filing an LLC-12 Form?

Statements and reports filed late are subject to a $250.00 penalty. (Sections 17713.07(b) and 17713.09; California Revenue and Taxation Code section 19141.) The California Secretary of State also has the right to suspend or forfeit your entity’s powers, rights and privileges for failure to submit a status report on your company.

Don’t take a chance on losing the protections and benefits of your California LLC. Make sure to file your Form LLC-12 in a timely manner so you can keep doing business as an official legal entity that is fully in compliance with the state authorities.

I Don’t Want to Mess This Up. Can a Professional Do This for Me?

Legal documents can be intimidating and confusing to fill out. Trusted by more than 250,000 companies, Incfile can help you file your California Statement of Information (Form LLC-12). Working with Incfile can give you peace of mind that your business information is getting filed correctly and all the steps are complete. Contact Incfile and talk with a representative about how we can help keep your California LLC in good standing for the next two years.