You’ve done your research, written a brilliant business plan and laid the foundation for your new business. Now it’s time to think about taxes. The next step in starting your small business is getting an Employer ID Number (EIN) and understanding the differences between the EIN vs. SSN (Social Security Number).

The IRS has specific rules regulating when an EIN is required, so it is vital that you do the research in advance to make sure you are operating your business in a way that complies with all laws and regulations. Knowing the difference between EIN vs. SSN can also help you potentially save money during tax time and protect your personal assets by keeping your business and personal finances separate.

What's the Difference Between SSN and EIN?

As we begin to dig deeper into an understanding of EIN vs. SSN, here are some key terms to know and understand:

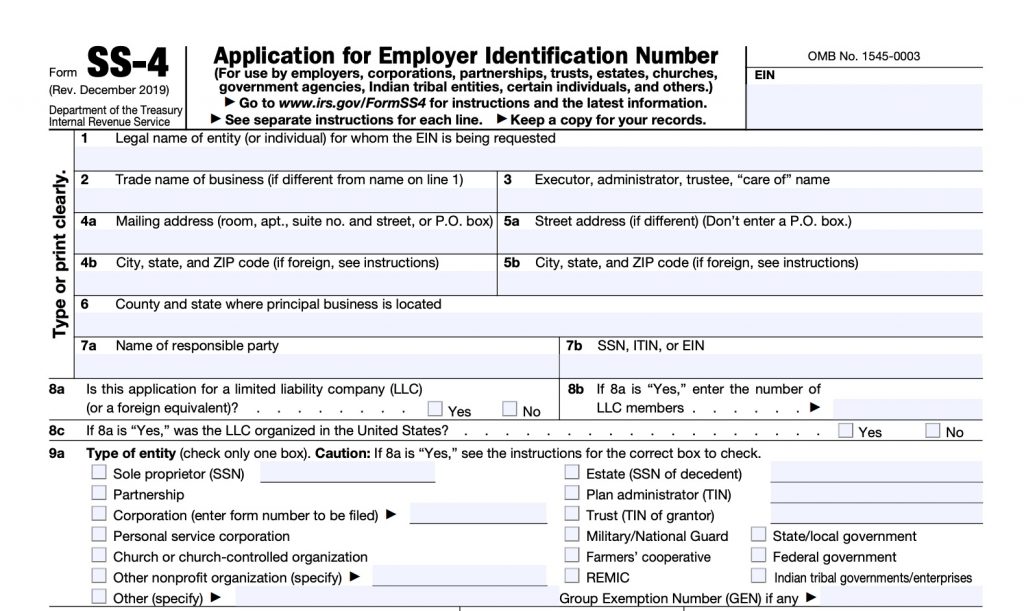

- EIN: Employer Identification Number, also referred to as the Federal Employer Identification Number or the Federal Tax Identification Number (TIN). The EIN is a unique nine-digit number assigned by the IRS (Internal Revenue Service) to business entities operating in the U.S. for the purpose of identification. You can get an EIN with Incfile’s help or by filling out IRS Form SS-4.

- SSN: Social Security Number; a nine-digit number issued to U.S. citizens, permanent residents and temporary residents. The SSN is used as a Tax Identification Number (TIN) for individual tax filers.

If you own and operate a small business with no other employees, it is your option to elect to use your SSN as the TIN for your business. However, if you have employees, an EIN becomes necessary. Most tax-related documents require the use of a TIN, and for the purposes of your business, the TIN will either be your personal SSN or the EIN you are assigned when you apply for one. Whether an EIN is required is clearly laid out by the IRS; there is very little ambiguity and most of the exceptions to the rule are clearly defined.

How to Determine If You Need an EIN for Your Business

According to the IRS, these are the scenarios in which you would need an EIN for your business:

- You have employees.

- You operate your business as a corporation or a partnership.

- You file tax returns for any of the following: Employment, Excise, or Alcohol, Tobacco and Firearms.

- You withhold taxes on income, other than wages, paid to a non-resident alien.

- You have a Keogh Plan.

- You are involved with any of the following types of organizations (per irs.gov):

- Trusts (exceptions for some grantor-owned revocable trusts), IRAs, Exempt Organization Business Income Tax Returns

- Estates

- Real estate mortgage investment conduits

- Nonprofit organizations

- Farmers' cooperatives

- Plan administrators

If your answer to any of the above statements is ‘YES,’ then you will need to apply for an EIN for your business.

The circumstances in which you can make the choice not to have an EIN as a business are somewhat limited. As you can see above, you need to be an individual operation with no employees; freelancers and independent contractors fall in this category. This begs the question, what about a sole proprietorship or an LLC (limited liability company)?

If you are a sole proprietorship with no employees, but you intend to add employees in the future, it could be best to get your EIN now. If you are the single-member owner of a sole proprietorship or an LLC, and you intend to stay a single-member operation, you very likely do not need an EIN. As with all things tax-related, there are exceptions. For a single-member LLC classified as a disregarded entity, these exceptions come into play if the LLC has employees or if it will be required to file certain excise tax forms. Do your due diligence if you are forming an LLC to ensure you are making the correct selection between an EIN and SSN.

What If You Prefer to Use an EIN vs. SSN?

In the event that your business does not fall under one of the scenarios where an EIN is required by the IRS, the next decision you must make is whether or not you choose to get an EIN for your business. Even if you are not required to use an EIN, and even if you could use an SSN instead, sometimes the EIN might be a better option for your business, financial and tax planning goals.

There is one significant benefit to choosing to use an EIN over your personal SSN for your business — avoiding identity theft. Think of the EIN as being the SSN for your business. Once you register an EIN for your business, you will be able to provide that number instead of your SSN to your clients, which means you will not have to provide your personal SSN to potentially dozens of individual customers or clients.

When you choose to use an EIN, your business’s tax returns will be filed under the company EIN and be kept separate from your personal tax return. Having an EIN also provides an additional layer of separation between your personal and business finances as your EIN will be utilized when setting up business accounts. An additional layer of safety and separation is a good thing when it comes to protecting your personal information and creating a separate legal identity for your business and personal life.

You may also find that other companies prefer to work with businesses that have an EIN, and in fact, some may insist upon it. An EIN can give a small, independent business a little extra image of professionalism.

Bottom line: if you have already gone through the effort of forming an LLC and getting a business bank account, you might as well use an EIN to manage your business finances and file your business taxes, even if you could choose to use an SSN instead. Using an EIN helps create a separation between your business and personal finances and can make your life as a business owner a little bit easier, during tax season and all year round.

EIN vs. SSN: Filing Taxes

Regardless of whether you choose to use an EIN or your SSN for your business, you will need to file taxes as an individual and possibly also will have to file taxes for your business. According to the IRS, all businesses except for partnerships are required to file annual income tax returns. If you are a self-employed individual or sole proprietor and have opted to go with your SSN for your business income, you will file your taxes as an individual and report your business profit or loss there using Schedule C with Form 1040.

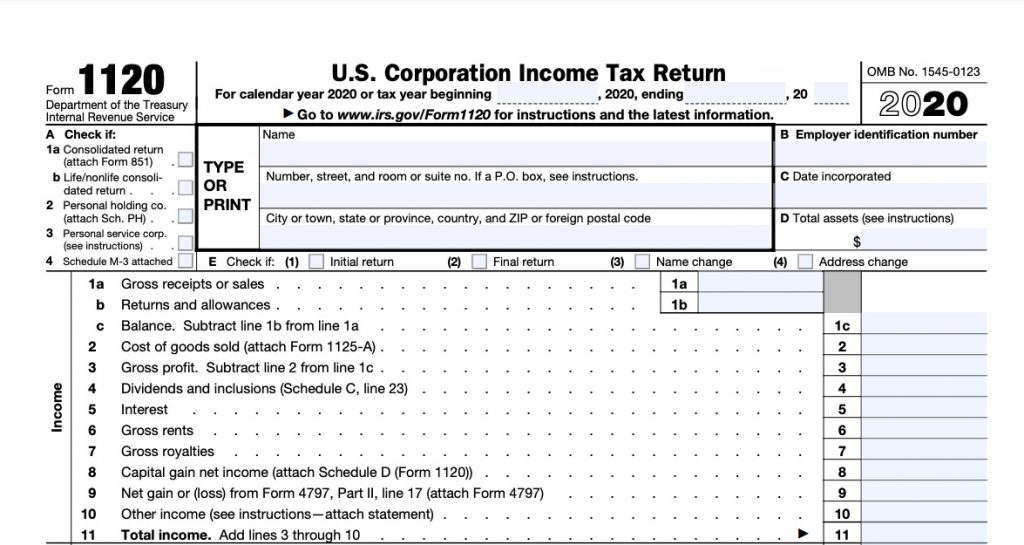

If you have set up your business as a legal entity, such as an LLC, you are required to file a business tax return. This is where you would use the EIN for your business to identify your business as a separate legal entity from your personal identity for tax purposes. The business tax returns will be filed independently from your personal, individual tax return.

While there are a number of benefits related to using an EIN as discussed above, in the end, it’s a personal choice for you to make in the best interest of you and your business. As long as you are following the rules and regulations laid out by the IRS, the choice is yours. Talk to an accountant or other professional tax adviser if you have questions about how to best prepare for tax season and how to organize your business for tax purposes.