Corporations and nonprofits registered in Delaware must file their annual report online with the Delaware Secretary of State by March 1, 2023. Failure to meet this deadline can result in late fees and penalties and put the business entity at risk of losing its good-standing status. Marking your calendar or adding a reminder notification may not be enough to help you prepare for this looming due date. To help you get a head start on meeting Delaware’s annual report due date and paying your franchise tax, we’ve put together this easy-to-follow guide to navigate you through the filing process.

How to File Your Delaware Annual Report

Filing your Delaware annual report is a yearly requirement in Delaware for corporations and is crucial to maintaining a business’s good standing within the state. All businesses, corporations and LLCs included, must pay a Delaware franchise fee, which is a yearly tax for all companies doing business in the state.

Luckily, filing an annual report and paying your franchise fee can be straightforward, and most times, the information will match what was submitted in previous years. If you've had changes to your company, such as a primary address, the names of the officers and directors, a change of Registered Agent, etc., this information will need to be updated.

Find Your Entity File Number

To begin the process of filing your annual report, the first step is to find your business entity file number. The file number is seven digits long and is issued by the State of Delaware. (Your file number should not be confused with the EIN, which is issued by the Internal Revenue Service.) Here's how you can find your number:

Once the business entity file has been retrieved, the annual filing must be completed online.

Fill out Delaware Annual Report Information

Once you’ve entered the website for the Delaware Division of Corporation and input your business entity’s file number, you will enter the system and can begin the process of filing your annual report.

Key information that will need to be filled in online in order to complete filing the annual report will include:

- Stock details (stock class, number of shares, par value of shares, gross assets, etc.)

- Principal place of business

- Officer information

- Directors/board member information

- Federal tax ID/EIN

File Your Report

Once that’s all entered within the designated cells, you’ll need to sign off on the “terms and conditions” and will then be presented with the option to either “save and exit” or “continue filing.” Pressing the latter will allow you to review your keyed information and submit the filing. You'll need to pay your annual report filing fee, along with your franchise fee (more on that below).

Annual Report Requirements

It is important to note that the information provided on the annual report must be accurate to avoid any repercussions of filing false information, including voiding the application and losing good standing status. It is also a requirement that the person filling out the application should be a corporate officer (president, treasurer, secretary) or an authorized board member.

Should there be an unintended error in the submitted information, an amended annual report can be filed for $50. This can be done at any time during a one-year period, but the sooner the error is corrected, the better.

As noted in the preceding section, filing a report in Delaware is an easy process and can be completed in a matter of minutes as long as all the required information is available and the estimated tax responsibilities have been assessed.

Requirements for the main entity types — corporations, limited liability companies, and nonprofits — may vary. This includes filing dates and tax amounts. And keep in mind, even if you haven’t engaged in any business during the calendar year, you’ll still need to file an annual report and pay the tax.

LLC Requirements

A key difference between LLCs and corporations is that LLCs do not need to file an annual report. Another difference is that, unlike corporations that need to file their annual report and franchise tax by March 1, LLCs have a due date of June 1 to meet their tax fee obligations.

The tax for an LLC is a flat fee of $300. This tax is assessed by the state whether or not the company is active and conducting business activities during the calendar year. The responsibility here lies solely in paying the franchise tax. Failure to file and submit the $300 tax by June 1 will result in a $200 penalty along with the 1.5% monthly interest charge.

Key dates and fees to remember for LLCs:

- Limited Liability Company (LLC) — Fee: $300; Due Date: June 1

- Limited Partnership (LP) — Fee: $300; Due Date: June 1

- Limited Liability Partnership (LLP) — Fee: $200 per partner; Due Date: June 1

Corporation Requirements

The Delaware annual report due date for corporations is on March 1 but can be filed before this due date. Just as with LLCs, failure to file and submit tax payments will result in a penalty of $200 plus 1.5% interest each month.

Corporations pay $50 to file. This fee is on top of the tax responsibility, which has a current minimum payment requirement of $175 using the Authorized Shares Method and a minimum charge of $400 utilizing the Assumed Par Value Capital Method.

More key dates and fees to remember for corporations:

- Corporation (5,000 shares or less) — Fee: $175; Due Date: March 1

- Corporation (5,001 shares or less) — Fee: $200-$200,000 (max); Due Date: March 1

Nonprofit Requirements

Exempt domestic corporations must pay a $25 filing fee. Nonprofits do not pay a franchise tax.

To qualify as an exempt corporation, the business entity must be recognized as a 501(c) by the IRS. This means that nonprofits are not required to pay Delaware state taxes.

Calculating Franchise Taxes in Delaware

The State of Delaware offers two methods to calculate its franchise tax: the Authorized Shares Method and the Assumed Par Value Method. Let’s break it down:

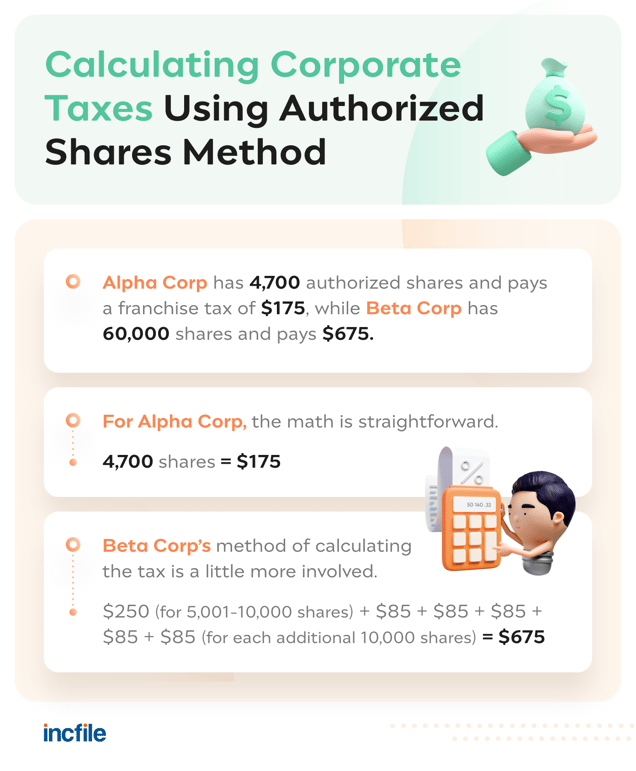

Method 1: Authorized Shares Method

A corporation with 5,000 shares or less can pay the minimum tax of $175. If the corporation has 5,001-10,000 shares, the tax is increased to $250. However, things can get a little more complicated and expensive if the corporation has more than $10,000 shares. If that happens to be the case, the corporation will need to add an extra $85 to its franchise tax bill for each additional 10,000 shares.

Corporations using the authorized shares method will pay a minimum of $175 and a maximum of $200,000.

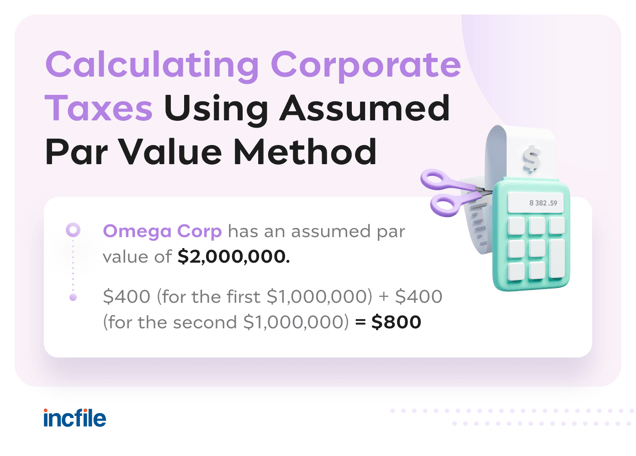

Method #2: Assumed Par Value Method

A second method for calculating taxes, called the Assumed Par Value Method, requires a corporation to report total issues plus total gross assets. The math here is a little more complicated since, in addition to the number of issued shares, the filing will need to also include the corporation’s gross assets.

Using the Assumed Par Value Method, the tax responsibility is calculated at the rate of $400 for each $1,000,000 of total gross assets.

Corporations using the assumed par value method will pay a minimum of $400 and a maximum of $200,000.

Don't forget to add the $50 filing fee once the taxes are calculated! Franchise taxes can only be paid online either by credit card or checking account. Additional support can be offered using the Delaware franchise tax calculator.

Delaware Annual Report FAQs

If you have any more questions about filing a Delaware annual report, here are some frequently asked questions.

Does Delaware Require Annual Reports?

Corporations formed in Delaware are required to file an annual report as well as pay their annual franchise tax. Nonprofit corporations must also file an annual report with the Secretary of State, but unlike a nonexempt corporation, they do not pay a tax.

Limited Liability Companies (LLCs), Limited Liability Partnerships (LLPs), and Limited Partnerships (LPs) do not need to file annual reports, but these business entities must pay taxes.

Does a Delaware LLC Have a Filing Fee Every Year?

Since LLCs do not need to file an annual report, they don't have a filing fee each year. (Corporations, on the other hand, submit a report and pay a $50 filing fee; nonprofits pay $25). The main obligation of the LLC is to pay the franchise tax ($300).

Are Annual Reports Mandatory?

Annual reports are required for corporations and nonprofits. LLCs, LLPs, and LPs in Delaware don't need to file an annual report.

Determining and meeting your business’s annual filing date is crucial in order to remain compliant with the Secretary of State.

The best plan would be to make sure that you do not neglect your annual report filing in the first place. Filing early is always an option. Once you’ve done so, you can check that off your “to-do” list for another year and get back to the business of running your business.

Get Help With Filing Your Report

Don’t let a missed filing date jeopardize your business! (And don’t rely on an email or postcard reminder from the state or sticky note on your computer.) Whether you’re filing just in the state of Delaware, or in multiple states, consider streamlining the task and hiring a professional service to manage your annual filing requirements.

Incfile's Bookkeeping and Accounting service can help you meet your annual report filing deadlines and accounting needs.