No matter how much we research and plan, life is constantly evolving. Changes in trends, advancements in technology, increases in consumer demand or even transitions in your personal life can influence how we run our company.

These factors may have caused you to choose one name for your business in the beginning, but now the original name may not really fit your image or what you have to offer anymore. Regardless of your reasons for changing your business name, the process is simple and easy to accomplish.

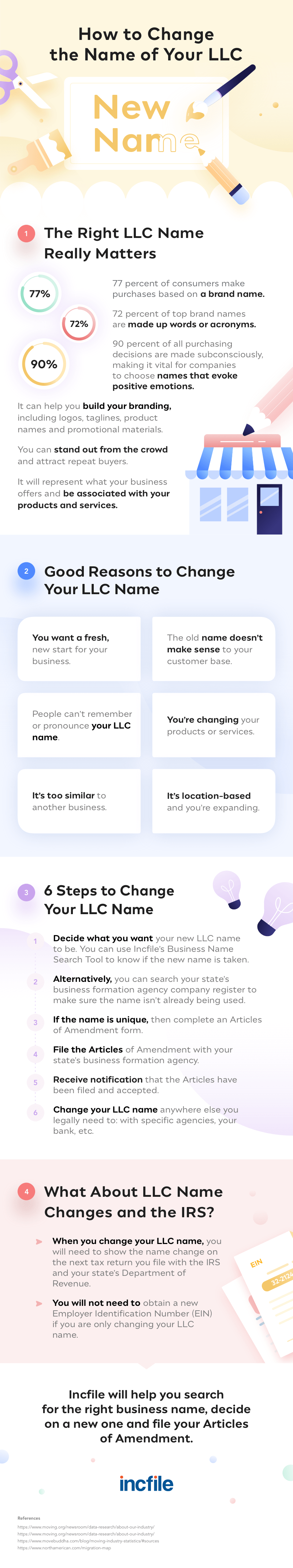

Changing the Name of Your LLC

If you currently have a Limited Liability Company (LLC) and want to change the LLC's name (or any other information that was part of the original filing such as address or members), a Certificate of Amendment must be filed with the form provided by your secretary of state. There will also be a filing fee that must be paid when you submit the amendment.

For example, if you live in California you can type in "California Secretary of State" in your search engine. Click on the appropriate link and type in your topic ("LLC name change form") to find what you're looking for. In this specific circumstance, you'll need to fill out Amendment to the Articles of Organization (Form LLC-2).

Do I Need a New EIN If I Change My Business Name?

An Employer Identification Number (EIN) is like a Social Security number that the IRS gives to your specific company to identify your business for the following reasons:

- You have employees working for you and you need to fill out W9 forms.

- You own a partnership or corporation.

- You file any of the following tax returns: Employment, Excise or Alcohol, Tobacco and Firearms.

- You have a Keogh or Solo 401(k) retirement plan.

- You wish to open a bank account for your business that isn't linked to your personal accounts.

According to the IRS, you will need to apply for a new EIN if you change your entity type, if you become a subsidiary of a parent company or if you are a part of a statutory merger. You will not be required to obtain a new EIN for a corporate name or location change.

For example, let's say you and your friend Bob are co-owners (called "members" in an LLC) of The Pizza Shack. You both agree that it's time to create a more upscale image to attract additional customers. You decide that the first part of this process is to rename The Pizza Shack to Molto Bene Pizzaria. You do not need to get a new EIN, but you will need to change the name on your tax return to alert the IRS of this new information.

If, in fact, you do need to get a new EIN, you can do so by sending a letter to the IRS that is signed by a managing member stating your old name and what you wish to change it to. You can send this to the same address where you file your tax return. You can also include this information on a copy of the form the IRS originally sent to you when you received your first EIN.

Common Questions About Renaming Your LLC

Once you choose your business name, do you have to add "LLC" to the end of it? Well, it is a good thing to have LLC at the end of your name for a couple of reasons: It shows that you are a real company registered with the secretary of state, and it announces that your personal assets are protected if someone wants to sue your company.

However, what if you don't like the look of Lisa's Custom Creations, LLC? You can file a DBA (doing business as) form, which is also called a “fictitious business name." This allows you to drop the LLC part of your business name for everyday use.

I don't feel confident filing an amendment to my Articles of Organization. Where can I find help?

We understand that it can be intimidating to file legal paperwork which is why Incfile has legal experts who are ready to help you file your amendment. For only $99 plus state filing fees, we can help you to update your important information with the right forms and send them to the appropriate government departments. You can be confident that these amendments will be completed quickly and correctly.