A business license is a legal document allowing you to operate your business within a specific area, such as California. The requirements can vary between states and municipalities — some places may require a license for all types of businesses, while others may only require it for specific industries or activities.

For Californian business owners, we've compiled the answers to your most pressing questions about business licenses below.

California Small Business License Requirements

When do you need a business license in California? Most businesses are required to obtain a business license from the city or county in which they operate, and California small business license requirements can vary depending on the type of business and where it's located. In many cases, the requirements can be fairly strict and complex, and adherence is essential in order to avoid liability for any fines, penalties, or legal issues.

Some of the common permits required for businesses in California include the following:

- California Seller's Permit. To sell taxable goods in California, you'll need to have a Seller's Permit displayed conspicuously at your business.

- Alcoholic Beverages. If you're a winegrower, beer, brandy, or spirits manufacturer, or if you plan to sell alcohol to the public in any capacity, you'll need to apply for the corresponding permit with the California Department of Alcoholic Beverage Control.

- Cannabis Tax Permit. If you distribute cannabis, you'll need a Cannabis Tax Permit in addition to your Seller's Permit.

- Cigarette and Tobacco Products. To sell cigarettes and tobacco products in a retail capacity in California, you'll need a Cigarette and Tobacco Products Retailer's License in addition to your Seller's Permit.

- Covered Electronic Waste Recycling Fee (eWaste). For your business to sell covered electronic devices (computer monitors, laptops, etc.), you'll need an eWaste account in addition to your Seller's Permit.

- International Fuel Tax Agreement (IFTA). If you report fuel taxes as an interstate motor carrier, you'll need an IFTA license.

- Lead Acid Battery Fees. If you sell replacement lead-acid batteries in California, you'll need to register as a battery dealer and pay the California battery fee. If manufacture batteries, you'll need to register separately and pay the manufacturer battery fee.

- Lumber Products Assessment. There is a 1% assessment on purchases of lumber products and engineered wood products for use in California (based on the sale price).

- Tire Fee. If you sell new tires or lease/rent equipment with new tires, you'll need a tire fee account in addition to your Seller's Permit.

- Underground Storage Tank. If you own an underground storage tank, you'll need to register with the California Department of Tax and Fee Administration, file underground storage tank fee returns, and pay any associated fees for your reporting period.

If you aren't sure which types of licenses or permits your specific business requires, you can take advantage of Incfile's Business License Search Tool to manually check the requirements for your state and industry, or you can perform a search on the CalGold site.

Can You Operate a Business in California Without a License?

Most business owners operating in the state of California will need to apply for a business license from the municipality where the business is located. The state itself may not require any specific licenses, but whether you're operating your business within a municipality or an unincorporated area, there will always be local regulations to adhere to in order to avoid penalties.

It isn't solely about regulatory compliance, however. There are several benefits small businesses can access by obtaining the required licenses pertaining to their business type.

Benefits of Obtaining a Business License

Do you need a business license in California? You do, but there are benefits to obtaining a valid license in addition to legal compliance. These benefits can enable your business to do the following:

Build a Local Reputation

A business license is a tangible way to show your customers, vendors, suppliers, and partners that you are operating your business in a legitimate and trustworthy manner.

It can also demonstrate that you take your business seriously and are committed to serving your customers ethically, which helps to build credibility in your community. The more trust the public has in your business, the more sales, referrals, and positive experiences you can come to expect.

Gain Access to Funding

If you plan to apply for any loans or grants to help your business get started, the vast majority of applications will require your business to have all of the necessary licenses and permits. Any reputable funding entity must ensure the businesses they fund are legal and have met all regulatory requirements set forth by the state in which they operate.

By securing the required licenses, your business can increase its chances of being approved for funding, which will help you grow and expand.

Protect Intellectual Property

Obtaining licenses and permits can help you protect your business's intellectual property such as any trademarks, patents, or copyrights you own.

For example, a trademark license can allow your business to use its name or logo without worrying about infringement, while a patent license can protect your company's inventions and innovations.

Holding these licenses can also offer you legal recourse in case of any infringement by other businesses, enabling you to protect your business's intellectual property rights and defend it against potential legal predicaments.

Enhance Liability Protection

Accidents and injuries in the workplace are no joke, and incidents that occur on your business's property can cause significant stress. Liability insurance tied to your business license can help protect you against any claims for injuries or damages resulting from your business's operations.

Obtaining the appropriate licenses can also demonstrate to others that your business has taken reasonable and responsible steps to prevent accidents or injuries from occurring in the first place, which your lawyer will thank you for should an unfortunate situation arise.

Meet Tax Obligations

The last thing you want is to discover that your business has failed to comply with all of its tax obligations. Ensure you have all required licenses in place and you aren't accidentally committing tax avoidance or evasion.

Many licenses require businesses to register with the state or local tax authorities. If you don't comply with tax obligations, you run the risk of encountering penalties and/or legal action.

Expand to New Locations

As your business grows, you may wish to expand and open up shop in another location. Gaining the appropriate licenses and permits for your business can help facilitate its expansion by allowing it to operate in multiple locations or offer additional services.

The ability to show you've remained compliant in your initial location could help to expedite applications for your new location, especially if you wish to offer services that are specific to that location (expanding a microbrewery business to include a sit-down restaurant in another city, for example).

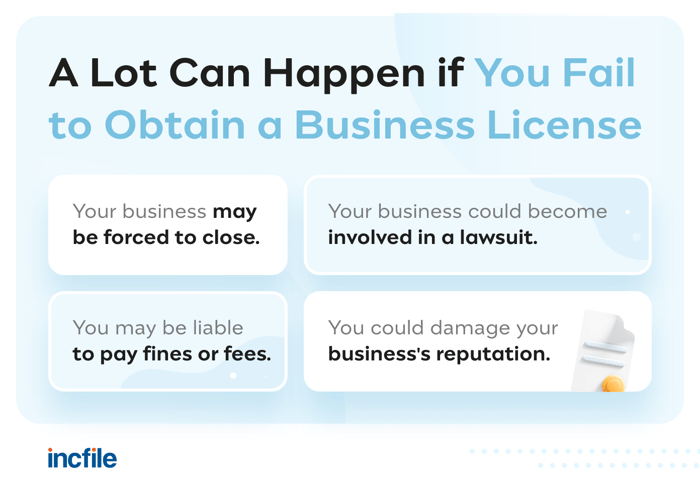

What Happens if You Don’t Have a Business License?

If you fail to apply for or obtain any business licenses or permits required for your business type and location, you could find yourself in hot water with your local jurisdiction, the authorities, and the courts. This is one of those cases where it is far easier to ask for permission beforehand than for forgiveness after.

There are a few significant downsides to failing to obtain a business license, and these setbacks can greatly impact your business's operation:

Your Business May Be Forced to Close

If your business is caught operating without a license, it could result in your business being forced to halt all operations and close. In some cases, your business may be able to reopen once the proper license is obtained, but you could face a mandatory waiting period, or the municipality might refuse to grant you a license altogether.

You May Be Liable to Pay Fines or Fees

Failing to obtain a required business license is illegal, and the severity of the infraction can vary depending on the type of industry as well as the location. Local fines, fees, and back taxes may be imposed for minor violations, but major infractions could mean charges, fines, and fees for your business from local, state, and even federal authorities.

Your Business Could Become Involved in a Lawsuit

The last thing a business owner needs is a lawsuit. If a customer isn't happy with the service provided, they could potentially file suit against your business in an attempt to seek reparations for any action they've deemed wrongful or negligent. If your business is found to be liable based on a lack of required licenses or permits, you'd be up against some significant costs.

You Could Damage Your Business's Reputation

Customers want to know your business is operating both legally and ethically. If you haven't bothered to seek out the appropriate licenses, it's likely your customers will notice. If you haven't set your business up legally, customers could lose trust in your business, and you might not be able to rebuild that trust moving forward.

How Much Does a Business License Cost in California?

Generally speaking, the cost to obtain a business license in the state of California can be anywhere from as low as $15 to as high as several hundred dollars. The cost varies depending on factors such as the type of business, where it's located, and any specific activities it participates in.

Some municipalities and counties may also require separate licenses or permits based on these factors, which can add to the overall cost of obtaining what you need to operate.

A business that handles hazardous materials, for example, will require you to obtain additional permits for safe handling and disposal. Restaurants and bars require permits to serve alcohol. Any specialized permit required will increase the cost of licensing overall, which it's why it's important to identify all business activities your company will engage in.

How Long Does It Take to Get a Business License in California?

In most cases, you should be able to receive your California business license within a few weeks of approval, but some municipalities take longer to process licenses than others.

In Sacramento, for example, the review and investigation of your business license application could take as long as 45 days to complete. This is why it's important to ensure you have included all the information required in your application and offer as much detail about your business activities as possible.

Is a Business License the Same as an LLC?

No, a business license is not the same as an LLC. A business license is a permit issued and authorized by a municipality or county indicating that you have permission to operate your business within a specific location. Business licenses ensure your business meets the necessary requirements and regulations to function both legally and safely.

A Limited Liability Company (LLC) is a type of legal business entity formed under state law to provide limited liability protection to its owners. This means that business assets and liabilities are separated from the personal assets and liabilities of the LLC's owners. LLCs are established by filing Articles of Organization with the state of California and paying a state filing fee of $75 (the fee is reduced to $0 from July 1, 2022, to June 30, 2023).

Obtaining a business license is a requirement for operating your business in most areas throughout California, but forming an LLC is a separate legal process that provides specific benefits and protections for you as the business owner.

Next Steps for Your Small Business

After you've applied for and obtained your business license, as well as any other licenses or permits required for your business type and location, there are several next steps you'll want to take in your business journey so you can start serving customers and growing your enterprise.

Write a Business Plan

Your business plan serves as a comprehensive guide that can help you through the many stages of running your business. Everything from your business structure to sales projections to how you'll reach certain milestones can be included. Plus, you'll need a business plan in order to apply for grants and funding if you don't possess all the capital required to get things off the ground.

Form an LLC

If you haven't made a decision to form a legal entity for your business, it's a step worth considering. When you form an LLC, you gain liability protection for your business that keeps your personal assets out of the picture. Forming an official business also helps build a reputation in your community and offers a host of other benefits.

If you aren't sure where to start, be sure to download our Start a Business Guide, where you'll find all the information you need to start your business legally and successfully.

Need Some Help Determining Your Licensing Needs?

Starting a business in California is exciting, but it can be nerve-wracking — especially if you aren't familiar with the required licenses and permits. Incfile's Business License Research Package uncovers all the requirements so you can get your California business off the ground.