There's a reason for that old cautionary tale about mixing business with pleasure, but maybe not the one you think. As a small business owner, you're faced with decisions every day, and the ones you make about your business finances could have the biggest impact on your future growth.

But it might surprise you to learn that more than a quarter of small business owners use a single checking account to manage both their business and personal finances. Having a dedicated business bank account is considered a best practice for most traditional small businesses, but with the ever-evolving landscape of remote work, side gigs and online and ecommerce business, you might be wondering if you really need one.

Here, we'll look at the upsides and the pitfalls of mingling your finances, what it could mean for your business and how to make the decision that's right for you.

Business vs. Personal Checking Accounts

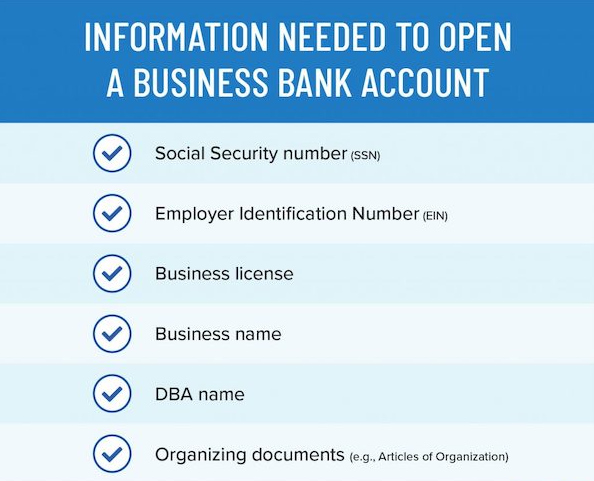

If you're wondering if there's a difference between business and personal checking accounts, the answer is both yes and no. When it comes to functionality, both types of accounts operate in mostly the same way. You can make deposits and withdrawals, set up automatic payments, write checks and use a debit card. But business accounts are different in that they have more requirements than personal checking. When you open a business checking account, you can expect:

- Higher overall fees, which may be waived if you meet certain requirements

- Minimum balances

- Limits on cash deposits

- More paperwork required to open the account

Do I Need a Business Checking Account?

The rule of thumb is nearly always that yes, you do need a business bank account to properly manage your finances. But if you have an online business rather than a traditional brick-and-mortar operation, is it still as important? We'll answer some of the most common questions to help make your decision, and avoid some of the most common mistakes.

Is a Business Checking Required?

Not exactly. If you're operating as a sole proprietor, there are no regulations stipulating that you must have a business bank account. If you have a legal business entity, on the other hand, a business checking becomes more than just a suggestion. LLCs and corporations must separate their business and personal finances. You could choose to set up two distinct personal accounts, but often, a bank will not open a personal account under a registered business name.

I Keep Track of My Receipts — Isn't That Enough?

Simply put, it isn't. Even if you have a legal business entity, muddying the waters between personal and business finances puts you at risk. You might think that an LLC is all you need to protect you from legal liability, but in fact, if you manage your business finances from a personal account, you could be putting it all in jeopardy. If you're faced with litigation, your personal assets — if mingled with your business finances — may be vulnerable.

How Can I Avoid the High Fees of a Business Checking Account?

There may be times when you can't. However, many banks will waive certain fees if you meet their requirements, which could include maintaining a minimum daily balance, having a certain number of monthly direct deposits or limiting transactions to avoid overage fees. Be sure to check with your bank to find out what types of waivers they offer, and what you'll need to do to get and maintain them.

What Are the Biggest Benefits of a Business Checking Account?

Aside from additional liability protection, separating your finances is simply good business. Keeping your personal and business accounts well-distanced from one another is a best practice that will help your business grow. Here's how:

- It makes your intent clear. No matter how much you earn from your online business, the IRS wants clear evidence that it's more than just a hobby. Even if you suffer a loss, having a separate business account will help the government classify you as a business.

- It makes tax time easier. Digging through piles of receipts is nobody's idea of fun, but if you mix personal and business finances, you might find yourself spending a lot of time doing just that. It's much simpler to claim deductions when your business has its own account that clearly and accurately identifies your expenses, overhead and income.

- It gives you credibility. When you're working to establish your online business, you want your customers to know you're legit. A business bank account will allow you to accept online credit card payments — something you can't do with a personal account. This makes your online business more professional, more trusted and easier to use for your customers.

- It will help you grow. Even if your business is still small, you may decide to expand in the future. Having a business bank account now, and managing it responsibly, will help you obtain business credit, loans and other funding when you're ready to grow.

How Much Money Do I Have to Make to Open a Business Checking?

None at all! In fact, you can open a business checking account before you ever turn a profit, and it should be one of the first tasks on your to-do list after you start your business. However, though you won't need proof of income or business viability, you may be required to open the account with a minimum deposit (which you'll need to maintain if you want to waive fees). Check out your bank options beforehand so you understand exactly how much you'll need to get started.

Bottom line: if you're wondering if your online business needs a separate business checking account, the answer is absolutely. While it isn't always a requirement, it is certainly a best practice if you want to grow your business and protect your personal assets. Need help choosing a business bank account that rewards you for doing business? Check out Bank of America's sign-up bonus and get started today.