Ready to launch your new business but not sure if you need Articles of Organization or an operating agreement (or maybe even both)? If you're planning to form an LLC, Articles of Organization are required. Operating agreements, however, are typically optional depending on your state, but your business can benefit greatly from having one. Here, we'll look at the differences and similarities between the two so you can understand which you need and how to get them.

What Are Articles of Organization?

Articles of Organization are the documents you'll file if you choose to form a limited liability company (LLC). While you're not required to file a legal business entity in order to run your business, a legal structure will provide you with many benefits, including liability protection. The documents you must file to form your business depend on the entity type you choose. C Corps and S Corps must file Articles of Incorporation, while LLCs must file Articles of Organization.

This documentation is required in all states before you can make your LLC official, though you might find them referred to by other names such as these:

- Certificate of Formation

- Certificate of Organization

While the documents may have different names, the purpose and the information required are the same across all states.

Your Articles of Organization are needed to start your LLC, but depending on your industry or profession, you might find that certain business licenses or permits are also required at the local, state, or federal level. In addition, you'll need some way to document your business to the IRS for tax filing purposes. Your Social Security number will work in some cases, but the best practice is to file for an EIN or Employer Identification Number.

And finally, you may also be required to file one additional document — an operating agreement.

What Is an Operating Agreement?

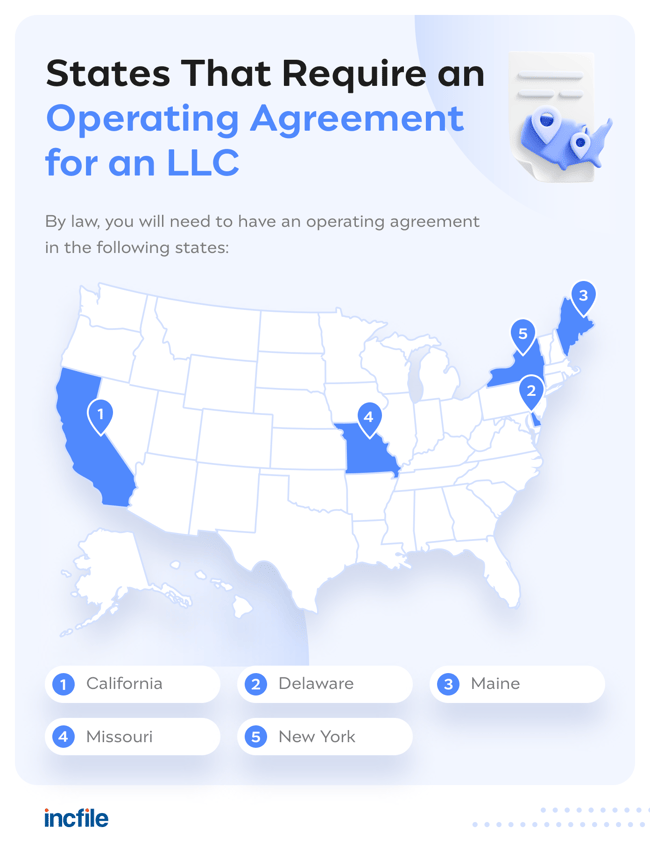

An operating agreement is a roadmap or blueprint that details how you'll run your business. It is not a legal requirement in most states, but if you're in one of the five states that do require it, you'll need to have it ready to file along with your Articles of Organization.

Operating agreements are required in the following states:

- California

- Delaware

- Maine

- Missouri

- New York

Even if you don't live (or aren't forming your business) in one of these states, drafting an operating agreement will help you make important decisions about your business — plus, it'll help you secure funding and form relationships with new business partners.

Differences Between Articles of Organization and Operating Agreements

As we've established, Articles of Organization and operating agreements are not the same things, but they each offer something valuable and necessary to LLC business owners. Here's how they differ:

Each Has Different Requirements

- Articles of Organization are always required if you're forming an LLC, regardless of state.

- Operating agreements are only required in the five states listed above.

- Articles of Organization must be filed when registering your LLC.

- Operating agreements must be filed alongside Articles of Organization in required states, but they can be created at any time in other states.

Each Serves a Different Purpose

- Articles of Organization are legal documents that make your LLC an official legal business entity.

- Articles of Organization contain all the basic information about your business, such as the name, address, and any LLC members.

- Operating agreements are contracts that outline how the business will be run.

- Operating agreements are critical when starting an LLC with other partners/members.

- Operating agreements detail how the business will be managed, the roles of each member, and what to do in the case of disputes or dissolution of the business.

Similarities Between Articles of Organization and Operating Agreements

We know these documents aren't the same thing, but they do have a few similarities:

Both Are Exclusive to LLCs

- LLCs file Articles of Organization, while corporations file Articles of Incorporation.

- LLCs create operating agreements, while corporations create similar documents called bylaws.

- Both Articles of Organization and operating agreements are fundamental to creating and operating a successful LLC.

Both May Be Handled by the State

- Your Articles of Organization (or Certificate of Formation) will be processed by the business formation agency in your state — usually the Secretary of State.

- If you are in one of the five states in which operating agreements are required, you will also need to file it through your state.

- No matter where your business is located, an operating agreement may be requested by state agencies in certain situations, like applying for grants, bringing on new members, or dissolution.

How to File Articles of Organization

Ready to register your LLC and file your Articles of Organization? Here are the steps you need to take:

- Determine which state agency handles business formation in your location. It's usually the Secretary of State, but some states utilize other departments.

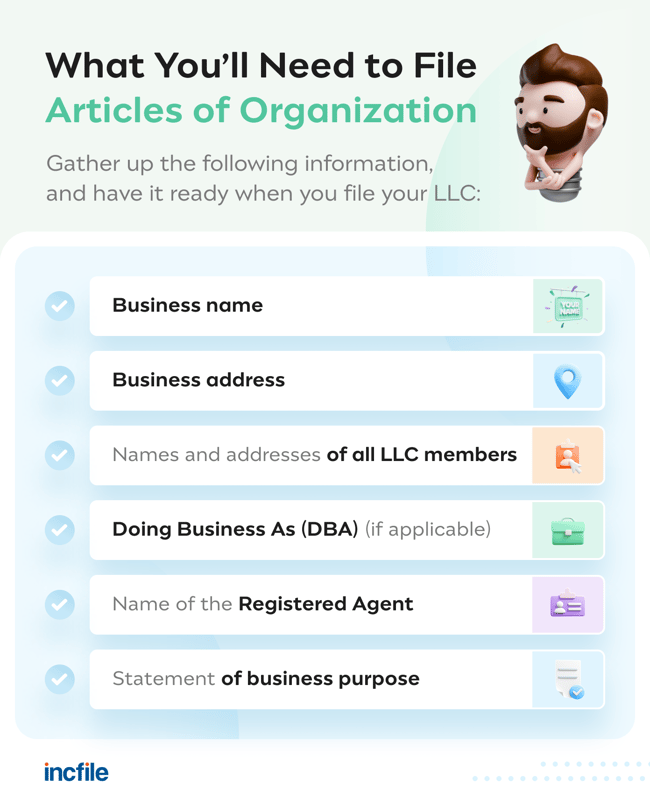

- Gather important information like the business name and address, the names and addresses of all LLC members, and your Registered Agent.

- Decide how you'll file. Most states allow online or in-person filing, while some permit filing by mail.

- Check into formation fees. All states charge a fee for LLC formation, ranging from $50 to $500 or more. You'll need to be prepared to pay when you file.

- Outsource to a business formation service. If the paperwork seems overwhelming, save time and stress by trusting a formation service like Incfile to file your Articles of Organization.

- Keep your Articles of Organization easily accessible. You may need to refer to these documents in the future.

Why Do Banks Need Articles of Organization?

Banks will often need to see your Articles of Organization, which is why it's important to keep them handy. Articles of Organization are proof that you're maintaining a legal business entity, and they show banks you're legitimate. Most of the time, banks will require Articles of Organization before you can open a business bank account or business credit card, which is crucial for separating your personal and business finances.

How to Compose an LLC Operating Agreement

Whether you're in one of the states where an operating agreement is required or creating one as a best practice, you'll need to understand exactly how to lay it out.

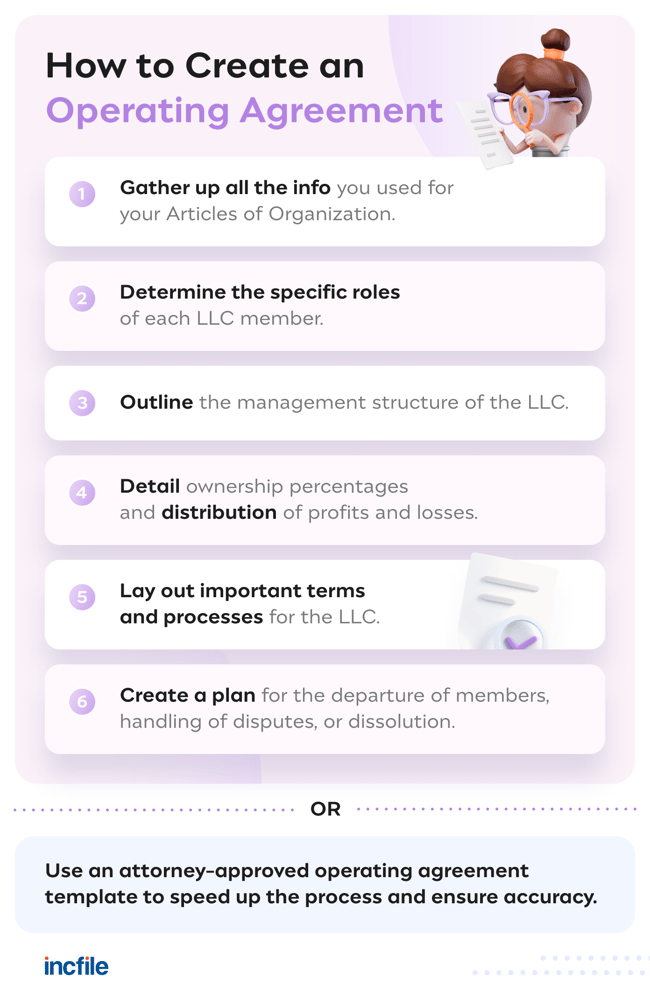

- Gather up the names and addresses of all LLC members, just as you did when filing your Articles of Organization.

- Name each member and list their specific roles.

- Detail the proposed management structure for the LLC — usually, it's member-managed or manager-managed.

- Determine how you'll handle finances, including ownership shares, distribution of profits and losses, accounting, and financial contributions.

- Set the terms for your LLC, including how often the members will meet, how to add and remove members, how to make amendments, any non-compete clauses, and how you'll keep records.

- Create an exit strategy. How will you handle it if the members wish to dissolve the business? What's the plan if that arises?

Can I Make My Own Operating Agreement?

You can certainly make your own operating agreement, but you must include all required information, especially if you're in a state where operating agreements are required. If you're worried about errors, opt for a lawyer-approved operating agreement template. A template will streamline the application process and ensure you have a comprehensive, accurate operating agreement for your business.

Do I Need an Operating Agreement if It's Just Me?

Even if you're the only employee in your business, you'll need an operating agreement if you live in one of the five states that require it (California, Delaware, Maine, Missouri, and New York). Otherwise, it's not a requirement. Operating agreements are most useful to business partnerships. However, they're still useful for single-member LLCs, too. They can help you determine your goals, and they can act as a roadmap for handling your business operations. Even if other partners aren't involved, you can still benefit from a thorough operating agreement.

Articles of Organization vs. Operating Agreements: Why the Best Choice Is Both

If you're starting an LLC, you're going to be filing Articles of Organization no matter what. And whether you live in a state that requires an operating agreement or not, you'll still benefit from having an agreement that's well-planned and well-executed. If you're feeling overwhelmed or have a complicated business structure, a business formation service can help.

Incfile can file your Articles of Organization and form your LLC for $0 + the state fee, and we can help you create your operating agreement through our legal contract library. Our library is included with our Gold and Platinum packages, or you can add premium access to the library and get dozens of binding, lawyer-approved contract templates on demand.